Mirjam BambergerChief Strategic Development Officer, AXA in Europe & Latin America

February 21, 2022

I once bought property on the moon. Now I am buying Metaverse land.

Artificial Intelligence in Insurance. AXA has entered the Metaverse.

6 minutes

Ten years ago, I bought some property on the moon. Lunar Land Authority sent me the official documents which included a satellite photograph and a title deed on engraved paper, promptly delivered.

Welcome to the moon. Lunar land ownership seemed like an intriguing idea. So I also bought several adjacent acres for my friends and family. Just in case we would want to socialize an spent some joyful hours at Lacus Somniorum one day.

Nowadays you may acquire and easily own

a plot of moonspace encrypted and secured. Your deed is stored on blockchain delivered as NFT, as a non-fungible token.

In fact, acquiring a piece of land next to earth

is no longer a visionary thing to do. It's rather real.

So lately I planned to acquire a small plot of Sandbox territory; to grow some tomatoes on, peacefully. I dropped the idea when digital real estate prices at Sandbox shot up 700%. Instead, I connected my modest crypto-wallet to OpenSea, a larger NFT market place. I am still looking for my perfect plot of Metaverse land to buy.

1. Artificial Intelligence in Insurance: Think ahead, place your bet

Metaverse uses artificial intelligence (AI) and blockchain technology to create a digital virtual world. Out there, you can safely and freely engage in social and economic activities that transcend the limits of the real world

. Sandbox and OpenSea are decentralized NFT metaverses. They enable us non-tech savvy users and crypto immigrants to create our own virtual reality.

And if you feel you can't quite follow, you may rest assured that buying NFT real estate is rather trivial. As a matter of fact, simply click the blue Buy Now

button which appears on the OpenSea page.

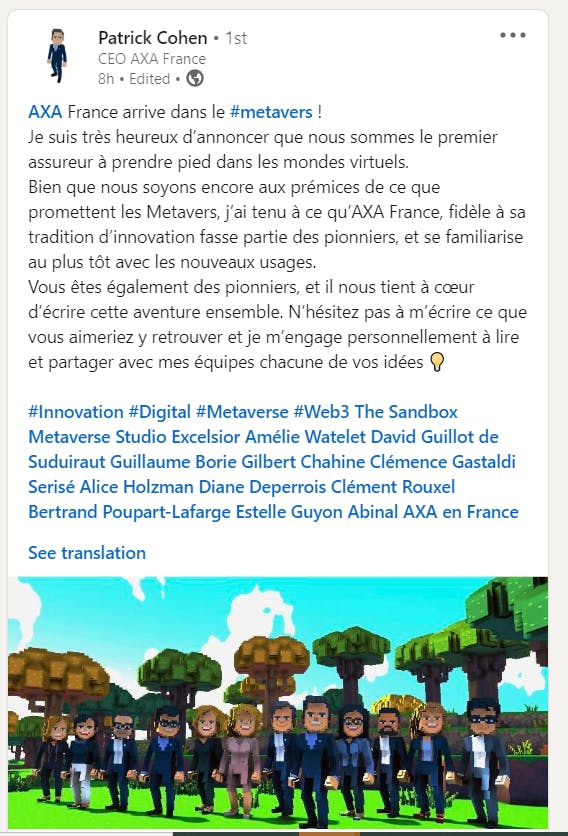

AXA has now entered Metaverse

Few days ago, AXA France confirmed to have secured a plot of virtual real estate on the Metaverse, produced by The SandBox.

AXA is the first player in French insurance and banking to establish a space in a virtual world. Why is that?

Void attraction or strategic intention?

There is no doubt that virtual spaces become more integrated into our daily lives. And part of pioneering is to learn and understand how insurance, how prevention or even assistance can happen virtually.

You may visit AXA on SandBox - and meet pioneering CEO's like Patrick Cohen and his team. If Metaverse is here to stay there is no doubt that some part of our socializing, servicing, travelling, working will migrate into virtual land. Entering Metaverse is about testing and learning.

2. Stay ahead of the curve: Three trends in Artificial Intelligence

Still, too far from here & now? Back to real world, there are concrete indicators of how AI will transform the way we produce and deliver insurance services in future.

If you take it beyond risk transfer, insurance is essentially a data business. Every company is a data company nowadays. Yet future of insurance will heavily and primarily depend on how well we use data and AI across the value chain.

We are data-driven to produce superior economic outcomes, and more than that. We leverage data to foresee risks and better protect in critical life moments. To drive you home safely, warn you about floods early, detect vulnerabilities in your health faster.

AI will consequently become one of the most powerful industry lever to reach revenue growth, improve technical margins and service our customers faster and better. In fact, there are at least three recent trends in AI which will shape 2022 and, in my view, also impact insurance.

Trend I: Algorithms enter into self-supervised learning

The so-called AI revolution

has been fueled by supervised learning. Data is being labelled for a particular output. Computer algorithms are supervised to learn along such labels. Independent of the amount of data offered, their learning remains a functional approximate

and depend on human intervention.

As the learning potential is reduced to labels, and such algorithms do not mirror human learning. We use context data to make sense and connect the dots.

In the last months, there have been first breakthroughs in self-supervised learning with models which do not need annotations and labels. Algorithms can analyze and cluster unlabeled data sets.

Neither trained nor never exposed to such data, these algorithms discover hidden patterns in data without the need for human intervention (hence, they are unsupervised

, more precisely, self-supervised

).

Trend II: AI is better trained, entering college this year

Self-supervised models exceed other models such as search, text classifications and to some extend even GTP-3, these are powerful new predictive models emerging only last year.

- For the first time, unstructured information can be translated into knowledge graphs.

- For the first time, complex questions to text data can be answered - even if the answer is implicit.

AI has literally entered first grade in college. Ask AI to read 2000 documents to extract the most important theses from the data. The quality of the results generated by GPT-3 makes it difficult to determine whether or not it was a text written by a human.

We are entering the realms of Artificial General Intelligence - AGI, with training possibilities unkown before. And for AI lovers, you may enjoy the TEDx video of guru Gary Marcus only 5 years ago - and figure where we are now, only few years later:

Trend III: Self-supervised AI is heavily funded and due to enter new frontiers

No wonder, Microsoft announced in September 2020, to pay billions for the exclusive access to GPT-3's underlying model. It is a new gold rush. Yet, a license will get you only so far.

The resources needed to fully exploit self-supervised learning are excessive. Today the cost of training a model at OpenAI, the San Francisco-based research laboratory, is verging around 5-20 millions of Euros.

Even with the best algorithms and teams in place, the training of the models will require vast amounts of GPUs. To train self-learning AI model, clusters of graphics processing units will not be sufficient. Up to 500 nodes with broad network speed of 4x200G between the nodes will be required to offer your algo

only one first training lap.

You get the picture: AI is no longer a matter of expert mathematician. It is a matter of staffing an interdisciplinary A-team composed of machine learning engineers, infrastructure and research engineers.

3. Into the future: How AI will impact Insurance

There is a wealth of applications of self-supervised learning in insurance.

- If we want to simplify email chains (yes, our clients would want that), keywords will give us the ability to produce a summary or extract a sentiment. With GTP-3 models, deep learning can produce human-like texts, and become even simpler and faster at times.

- Most importantly for insurance, AI models are becoming multi-modal. This means they can be fed with text and images alike, starting to resolve complex questions which could not have been solved with classic object recognition.

To give you one concrete example, AXA Switzerland, once again, stays at the forefront in pioneering and recently created Noimos.

Noimos is a Swiss based Insurtech specialized in AI to implement a new claims management process based on computer vision, augmented reality and machine learning. First mission of the start-up is to develop a solution for the management of motor claims (they are hiring, great team).

4. Conclusion: Testing, trying, learning

Insurance leaders must increasingly become technology-savvy executives. This sounds easy, but it is not. You must carve out time from your core activities. You must rewire the way you approach problem-solving and work your way into a whole new universe of tech talk and a myrriad of acronyms.

Despite all challenges, we share the belief at AXA that we must venture as leaders into AI rather sooner than later.

Patrick is one example of a pioneering CEO, landing in Metaverse with his team. Whilst this may not move the needle in profitable growth, technical margins or dividends today, it is a perfect example of AXA's belief that testing, trying, learning is the only way ahead of the curve.

Last but not least, SandBox plot owners or renters may become subject to natural disasters like storms or floods, and incur damages unless they have sought out insurance at AXA.

The content of this article reflects the opinions of the author concerned and not necessarily those of the AXA Group