August 3, 2023

Half Year 2023 Earnings

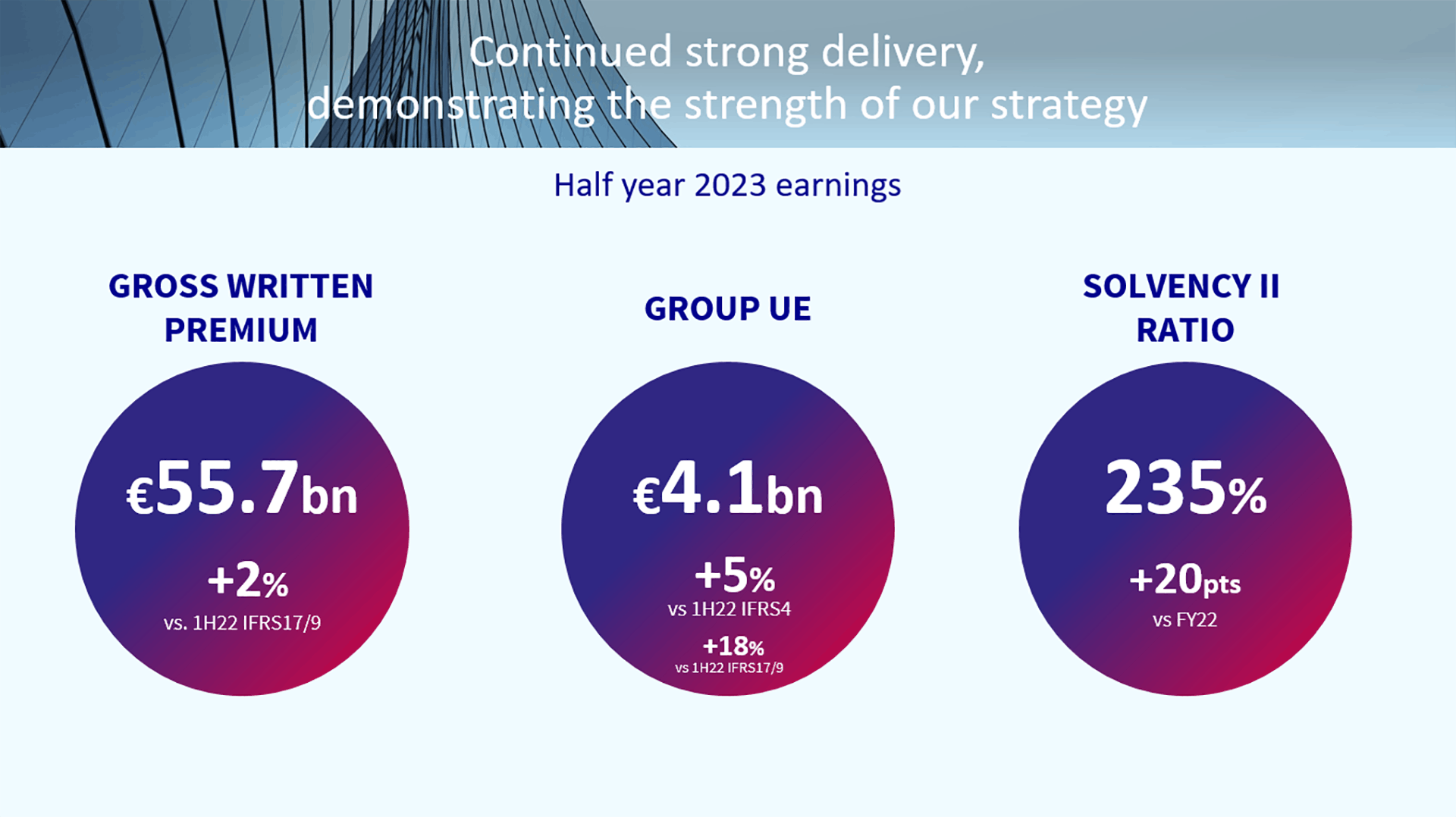

In the first half of 2023, AXA delivered another good set of results.

2 minutes

AXA presents today its Half Year 202 Earnings. You can follow the presentation to the media from 8.30 am CEST from 8.30 am CEST and the presentation to analysts and investors from 11 am CEST from 11 am CEST.

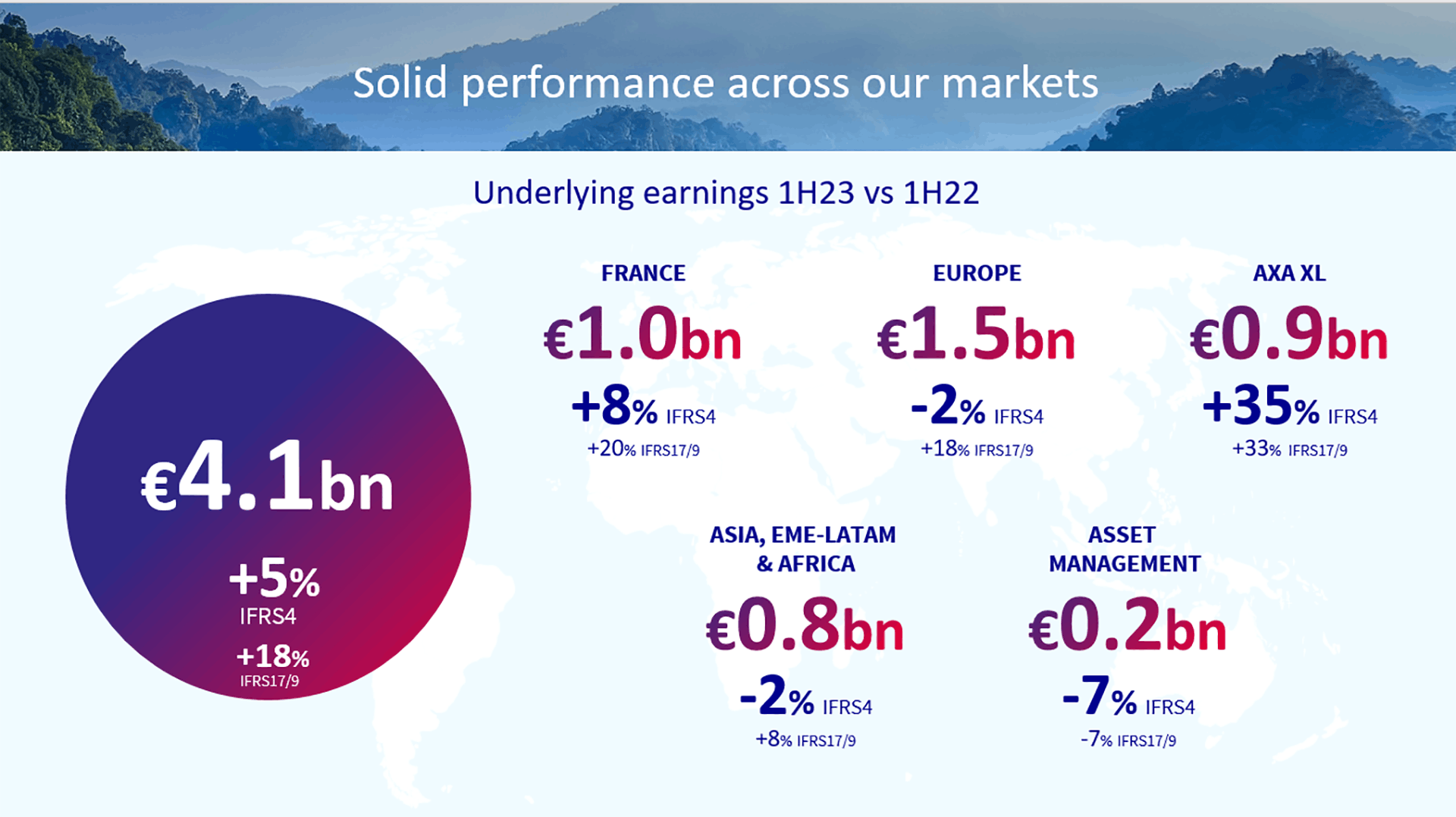

“We remain focused on executing our strategy, built on two pillars balanced between Commercial and Retail businesses. In P&C Commercial lines, premiums were up 9% and in P&C Retail lines, premiums were up 5%, both benefiting from a favorable pricing environment. We also continued to see good business dynamics in Employee Benefits, and a high-quality mix in our Life & Health Retail business.

Our distinctive franchise generated Euro 4.1 billion in underlying earnings, reflecting strong operational performance across our businesses and our ability to deliver consistent results despite a volatile environment. We continue to take actions to sustain attractive margins, including through disciplined pricing. We are on track to achieve our Group underlying earnings target for the year and we are confident in our capacity to deliver long-term revenue and profit growth,” said Thomas Buberl.

"The Group has further strengthened its balance sheet with a Solvency II ratio of 235% driven by operating capital generation and disciplined ALM that will further reduce our sensitivity to financial risks. Our asset allocation remains prudent and diversified.

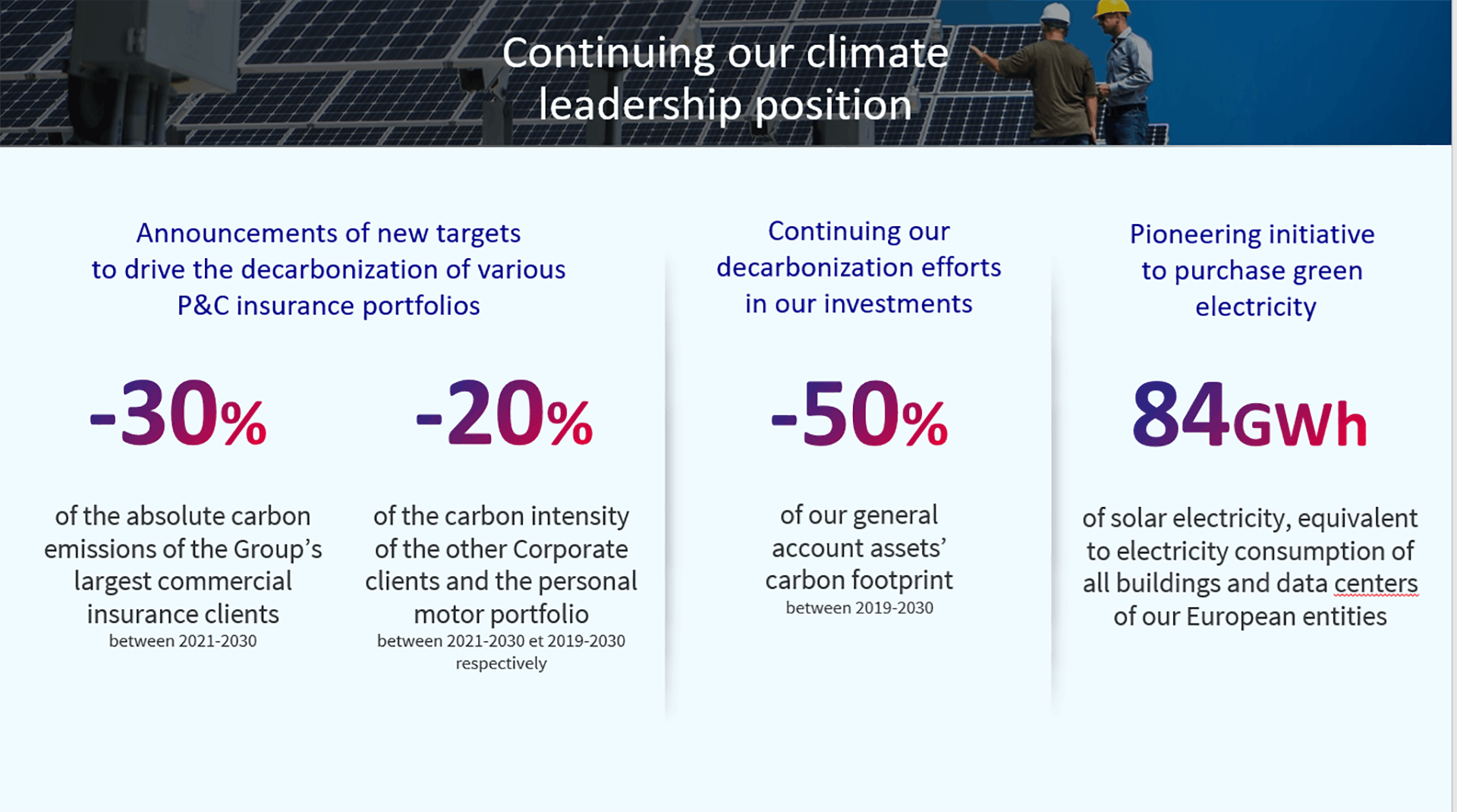

We recently announced ambitious new climate targets. For the first time, the Group set decarbonization targets on its P&C Insurance portfolio. We will continue working together with our clients and stakeholders, deploying our resources to support the transition to a low-carbon economy.

I would like to thank all our colleagues, agents and partners for their commitment and support, as well as our customers for their continued trust," added Thomas Buberl.