March 21, 2016

2000-2016: the AXA Group under Henri de Castries' leadership

First global insurance brand, second largest insurer by revenues, AXA has profoundly transformed since 2000 to become closer to its clients, more solid, more efficient, more geographically balanced, more innovative and more responsible. A new leadership team will now lead the Group through the next stages of its development.

6 minutes

Through the nineties, large transactions made AXA one of the leading international insurers. Since 2000, the first priority of the Group has been to focus on and develop its core businesses, namely insurance and asset management. AXA has also strengthened its geographical footprint, notably in emerging markets. More recently, the Group has engaged into an ambitious digital transformation.

Despite 3 majors crisis - the dotcom bubble, the subprime crisis and the Eurozone crisis – AXA comes out of the 2000-2016 period stronger, more focused and more competitive. It also benefits from several assets to further improve its leadership: the first global insurance brand, an increased financial solidity, an ecosystem of innovation and highly engaged teams - 166,000 women and men, employees and agents, serving 103 million clients across the world.

A focused development:

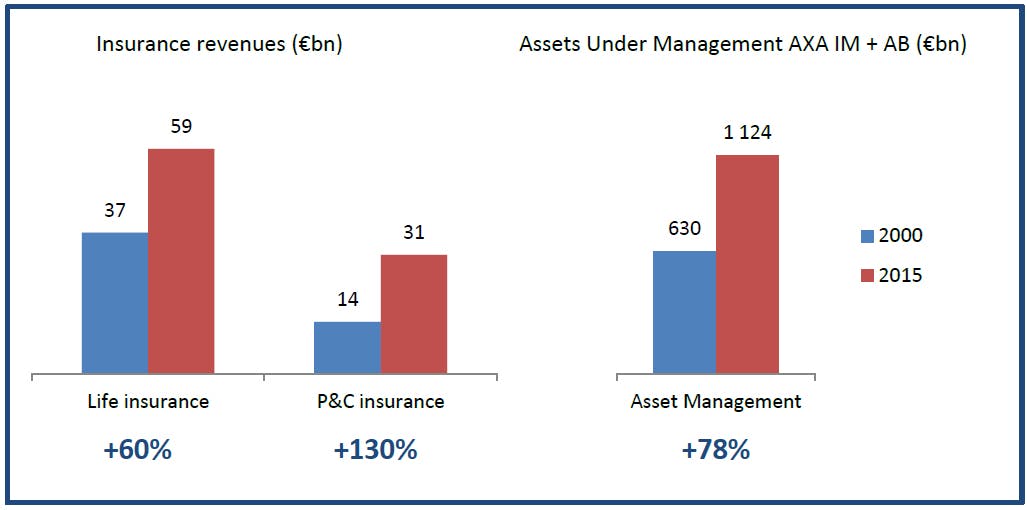

The momentum on its three businesses - life insurance, P&C insurance, asset management - has been supported by an active management of AXA’s portfolio, starting with the sale of non-core activities such as the investment bank DLJ during the summer 2000 (8bn$), the run off of the financial guarantee business, and the sale of the reinsurance unit in 2006.

In a second step, the Group sold businesses with limited market upside or weaker competitive position, including the Netherlands (2007), the wealth management business in the UK (2010), Australia (2011), Canada (2011), Hungary (2013, 2016) and Portugal (2015).

These transactions helped AXA strengthen its balance sheet and finance a significant part of its acquisitions in emerging markets over the period.

Targeted external growth:

Since 2000, the Group strengthened its international platform through focused acquisitions in markets where it was absent or with limited scale:

- First on developed markets, and notably:

- The acquisition of US life insurer Mony in 2004, increasing by 25% AXA’s distribution network in the US.

- The acquisition (7.5€bn) and the successful integration of Winterthur in 2006, then Europe’s 10th largest insurer, which helped AXA become market leader in Switzerland and considerably strengthened its positions in Germany and Spain.

- The acquisition of 50% of BMPS insurance operations in Italy in 2007.

- The acquisition of Genworth Lifestyle Protection Insurance in 2015, making AXA a European leader in credit and lifestyle protection. - Then on higher growth markets, and notably:

- South Korea (Kyobo Auto, 2007)

- Russia (participation in Reso Garantia, 2008)

- Turkey (minority buy-out, 2008)

- Mexico (Seguros ING, 2008)

- Asia (minority buy-out, 2011)

- China (partnership with ICBC, 2012)

- Asia (partnership in P&C insurance with HSBC, 2012)

- China (Tian Ping, 2014)

- Columbia (Colpatria, 2014)

- Nigeria (Mansard, 2014)

- Brazil (large risk business of SulAmerica , 2015)

- India (increased participation in Bharti AXA JVs, 2015)

- Egypt (partnership with Commercial International Bank, 2015)

Whereas AXA’s presence in emerging markets was not significant back in 2000, these transactions and the Group’s organic growth led to a position where high growth markets accounted for ca. 17% of AXA’s insurance activity in 2015.

Resilience through economic and financial crises

The last 16 years have been hit by severe economic and financial crises, including the dotcom bubble of 2001-2003, the subprime crisis of 2008-2009 and the Eurozone crisis, notably in 2012 and 2013.

Even during these moments of extreme volatility, AXA has always been a reliable partner for its clients, remained a profitable business, and managed to pay a dividend to its shareholders.

A 8-fold increase in underlying earnings

Compared to 1999 (672€m), AXA’s underlying earnings increased eightfold between 2000 and 2015, to reach its record level in 2015, at 5.6€bn. Underlying earnings express the Group’s ability to develop profitably its core operations. It does not take into account net capital gains or losses.

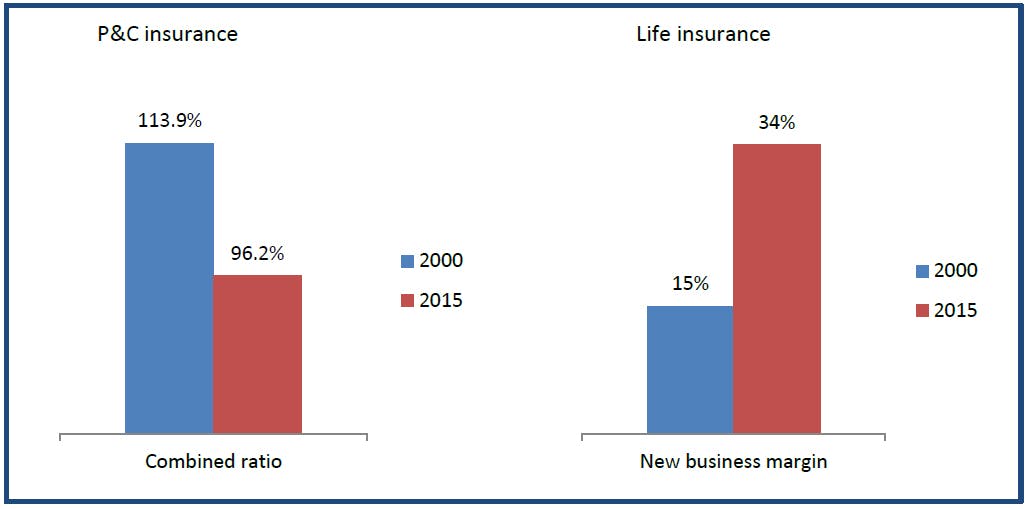

This focus on operational efficiency translates into a very strong improvement of the Group’s margins over the period.

The very strong improvement of the Group’s underlying profitability combined with the regulatory-driven decrease of investments in equities helped AXA’s results to be much less dependent from net capital gains or losses: in 2000, they accounted for 47% of AXA’s adjusted earnings, down to only 7% in 2015.

Strengthened financial solidity

A consequence of the large transactions of the 1990s, AXA’s gearing ratio stood at 54% in 2000.

Despite the extension of its footprint, the Group’s earnings capacity and the active and selective management of its portfolio have very significantly reduced its gearing, down to 23% at year-end 2015.

AXA’s Solvency 2 ratio, which stood at 205% at year-end 2015, is another proof of the Group’s financial strength. This level is one of the highest amongst large European insurers, while the European Solvency 2 supervisory regime is one of the most demanding in the world.

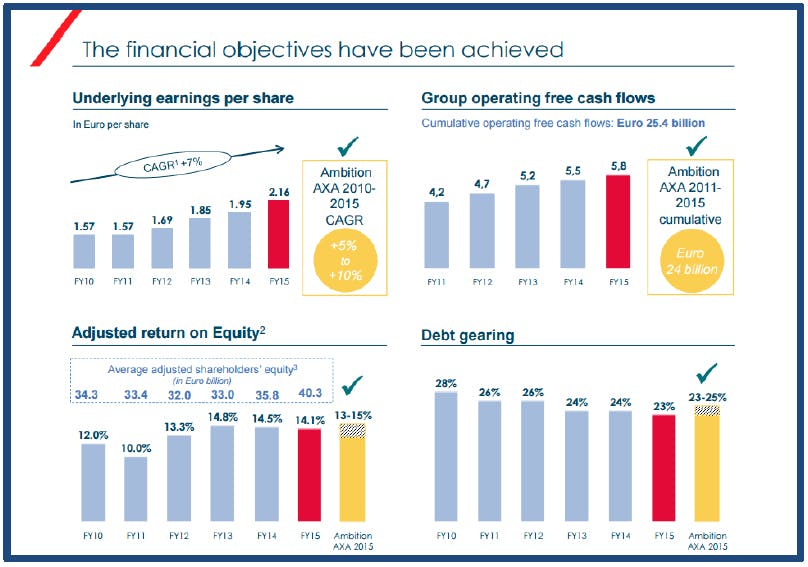

The success of Ambition AXA

The key objectives of the 5-year strategic plan Ambition AXA have been reached or even exceeded at the end of 2015, despite an unfavorable macro environment, including an unprecedented fall in interest rates, and financial turbulences such as the Eurozone crisis.

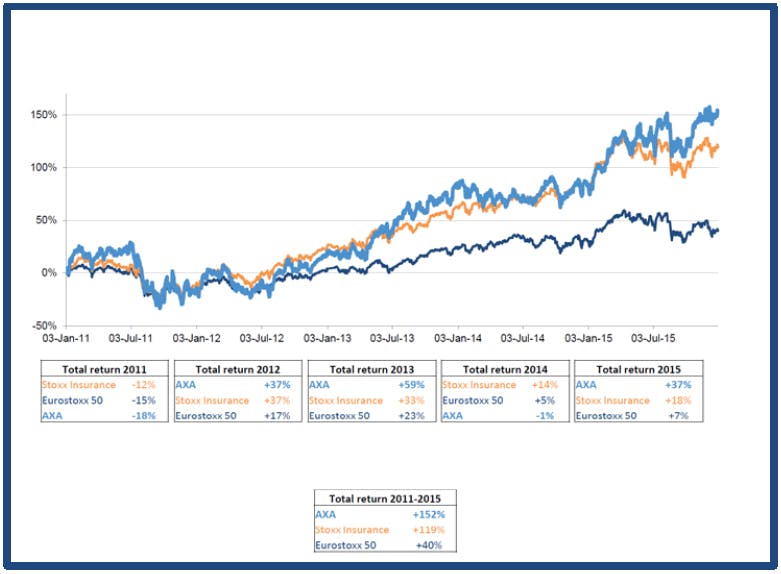

AXA stock’s performance also reflects the volatility of equity markets

The strategic plan Ambition AXA - and its successful achievement - helped AXA outperform its peers and benchmark indices: +152% (total shareholder return) over the plan, vs 119% for the insurance sector and +40% for the European benchmark index Eurostoxx 50:

The performance of AXA, of the insurance sector and of European equity markets as a whole is more contrasted over 2000 - 2016, as the period opened close to the high point of the dotcom bubble. Nevertheless, still based on total shareholder return (i.e. including reinvestment of dividends), AXA delivered a +12% performance over the period (31-12-1999 to 29-02-2016, on a monthly basis), vs. +6% for the European benchmark index (Eurostoxx).

The 1st global insurance brand

For the 7th consecutive year, AXA is the first global insurance brand, according to Interbrand. For the first time in 2015, it ranks amongst the all-sector 50 best global brands (#48).

The strength of the AXA brand is a symbol of trust for our existing and future clients. It is an asset to attract talents and sign partnerships. It also increases the visibility of the Group in the digital world.

A digital ecosystem to foster innovation and prepare the future

In a rapidly changing world, and in order to successfully achieve its transformation, AXA signed a series of partnerships with the leaders of the digital world (Facebook, Linkedin…), with scaling up startups (BlaBlaCar…) and developed its own ecosystem to foster digital innovation:

- An internal Digital Agency, to test, pilot and roll out innovative solutions across the Group, such as the mobile app MyAXA.

- AXA Labs, in San Francisco and Shanghai, to identify and create links with the most innovative startups and projects.

- Data Innovation Labs, in Paris and in Singapore, to help data scientists develop tomorrow’s services and models, based on big data.

- AXA Strategic Ventures, a 230€m fund to invest in the most promising fintech startups and accelerate their development by giving them access to the scale of AXA.

- Kamet, an incubation studio for the most disruptive insurance projects, with a 100€m funding.

Corporate responsability at the heart of our strategy

In 2014, AXA decided to combine its corporate responsibility team and its strategy team, as sustainable growth is the only way forward in a long term business. AXA’s corporate responsiblity strategy now covers every part of the value chain and every stakeholder of the Group, with highly visible initiatives such as:

- A pioneering role within the insurance sector in the fight against climate change, exemplified by the decision to sell coal-related investments in spring 2015.

- A commitment to youth employment, notably in Europe, which translates into a major involvement into the Alliance for Youth movement in Europe, with the objective for AXA of offering professional opportunities to at least 20,000 young people across Europe in 5 years.

- An active philanthropy to support science and research, in order to help our societies better understand risks. This is materialized through the AXA Research Fund, a unique 200€m philanthropic initiative to support top researchers across the world.

- The creation of a Data Advisory Panel to better address ethical questions linked to the management of data and big data projects.

- At year end 2015, AXA was ranked 6th (and 1st insurer) amongst international companies for the number of SRI funds in their capital (source Ipreo).

- AXA’s SRI ratings, amongst the best in its industry, underline the strength and the importance of this commitment to responsible development.