Arnaud Lebreton, Third Party Insurance Solutions, Head of AXA US & UK CRM and Deputy Head of AXAYolande Poulou, RI Solutions, Core Investments

June 24, 2022

The Ukraine crisis and its impact on insurers

Insurers already had a heavy agenda to contend with at the start of 2022 – not least an expected change in economic and financial regimes and some significant regulatory developments underway. The Ukraine crisis jolted investors and continues to have major implications for the global economy and financial markets, especially in Europe.

3 minutes

Original Content: AXA IM

Key points

- The Ukraine crisis has significantly impacted the financial and macroeconomic backdrop and adds to the already heavy burden on insurers

- Inflationary pressures are a drag on profitability and disturb balance sheets. Inflation risk should be factored into asset liability management and investment strategies. Close attention should be paid to duration gaps

- Insurance losses related to the war should be manageable for insurers, but the general uncertainty, volatility and risks tilted to the downside call for more insurance and agility in asset portfolios

- The war’s interference with climate action plans does not mitigate against physical and transitional risks. This calls for an acceleration in climate risk integration, both in liabilities and assets. The crisis will likely not slow the regulatory process underway, and insurers must be ready to manage these risks

War in Ukraine is adding to the burden

Insurers already had a heavy agenda to contend with at the start of 2022 – not least an expected change in economic and financial regimes and some significant regulatory developments underway.

Lingering COVID-19-related supply-side disruptions, alongside a significant rebound in consumer demand, were already producing supply bottlenecks and an inflation rate not seen for decades. At that time our central scenario was for a gradual absorption of the pandemic shock and of a normalisation of global supply chains, allowing for sustained growth, a slowdown in inflation and a digestible pace of monetary policy normalisation.

That said, the uncertainty around inflation, interest rates and the potential for more volatility already called for more prudence and for bringing more resilience in insurance balance sheets and asset portfolios.1

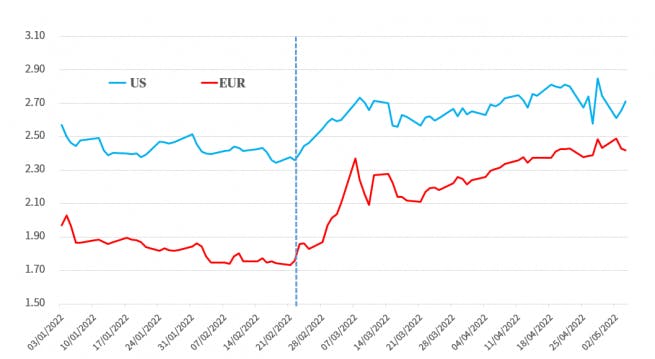

The Ukraine crisis jolted investors and continues to have major implications for the global economy and financial markets, especially in Europe. Volatility has surged, equity markets have sold off and credit spreads have widened especially for corporates with direct or indirect exposure to Russia. Europe is heavily dependent on Russia for its oil and gas which has further fuelled the environment of rising inflation. Exhibit 1 shows that rising pressures have pushed up inflation expectations further.

Exhibit 1: 5 year / 5 year forward inflation swaps – Euro vs. US

Source: Bloomberg – AXA IM

When the war broke out, the flight to quality was brief, and market participants quickly priced in further significant interest rates hikes, comforted by a more hawkish stance from central banks, which significantly impacted bond portfolios. High inflation hurts real incomes, dampens consumers’ confidence, and continues to feed concerns about the extent of monetary tightening and growth implications.

The job market is in good shape, corporate financing conditions remain affordable, and we continue to see earnings growth, but uncertainty is increasing. Supply chain disruptions, especially with new restrictions in China as a response to a resurgence of COVID-19, and geopolitics should impact GDP growth. This, combined with a high degree of uncertainty on the inflation trend and the pace of monetary tightening, should also translate into more frequent episodes of volatility in financial markets.

There is much talk around ‘stagflation’ – when slowing economies see rising prices – and while we do not see any market crash or credit crunch for now, our call to strengthen asset and liability management and build insurance portfolio resilience is even more valid than three months ago.

Read the full article

Download articleSource:

[1] No immediate storm ahead but insurers should use the lull to build portfolio resilience – AXA IM – January 2022

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales No: 01431068. Registered Office: 22 Bishopsgate London EC2N 4BQ

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.