Mirjam BambergerChief Strategic Development Officer, AXA in Europe & Latin America

October 5, 2022

Introducing a Paradigm Shift in Customer Protection

Consumer protection has become a prominent topic these days. Inflation is wiping out millions in value, a risk-averse Wall Street is struggling to get back up to its feet again. Economies grapple with inflation. And consumers grudgingly buy shrinkflated

products from the supermarket shelves. It is in this moment, when UK's Financial Services Regulator introduces a paradigm shift to the industry. The FCA's new ruling on Consumer Protection is a must read for an indicative route across European markets on customer conduct.

shrinkflatedproducts from the supermarket shelves. It is in this moment, when UK's Financial Services Regulator introduces a paradigm shift to the industry. The FCA's new ruling on Consumer Protection is a must read for an indicative route across European markets on customer conduct.

6 minutes

School bench knowledge suggests in some countries that a certain level inflation would generally be healthy. People would spend now rather than later expecting higher prices in future, and consumer spending would drive economic growth and prosperity.

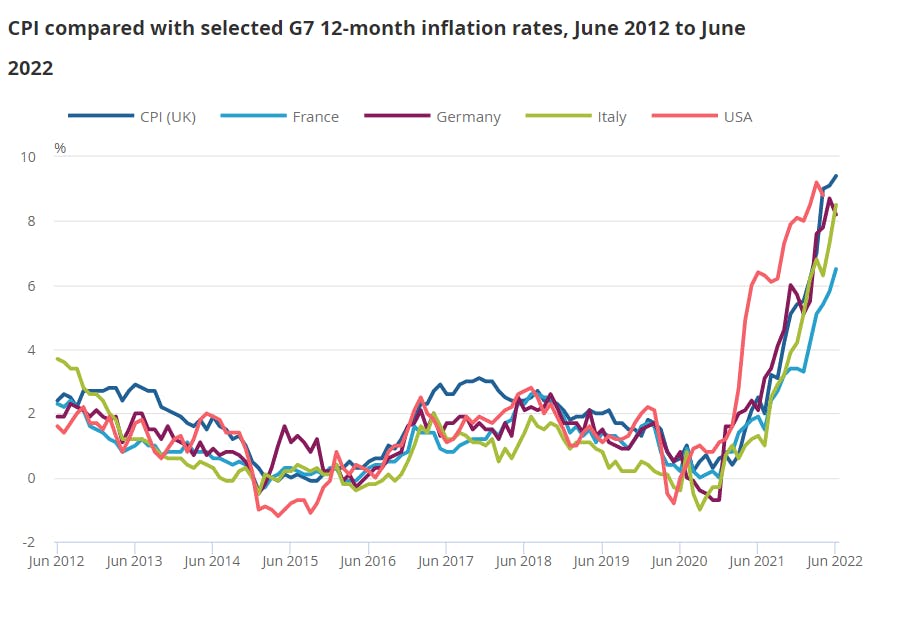

To mark a turn in textbook pages, CPI levels have been rising over the last months to 8-9% across Germany and UK. Even though experts expected in July inflation to decline after hitting a high of 8.5%, this is yet to happen. Rather to the opposite, costs of living reach historic ten-years-marks and private savings are eroding.

With an inflation outlook that is higher and persistent, consumption patterns have become disoriented. Inflation distorts price signals and consumers have largely reduced their discretionary spending across markets. Retail patterns change fast during turmoil:

- A sharp increase in the German retail demand for heating fans and convector heaters could paralyse the country's energy grid during winter.

- Within weeks, shinkflated products - same price, less quantity - dupe consumers into a false sense of stability.

We are living through desolate times of shrinkflation. Same price, less quantity dupe consumers into a false sense of stability.

So how can consumers make informed, effective decisions when economies are under stress and important consumption or investments decisions are to be taken in an increasingly complex environment.

A shift towards consumers in financial regulation

Consumer protection has become a more and more topical issue. This July, UK's Financial Conduct Authority (FCA) introduced a new Consumer Duty for regulated firms. It is considered one of the biggest shake-ups to UK retail regulation over the past 15 years.

The new Consumer Duty aims to drive a fundamental shift in financial services. The regulator's stated aim is to ensure a higher and more consistent standard of consumer protection for users of financial services. We want to see a higher level of consumer protection in retail financial markets, where firms compete vigorously in consumers’ interests.

How to deliver good consumer outcomes

The ultimate regulatory goal is to prevent harm before it happens. As a result, firms will need to ascertain whether they are delivering good outcomes for consumers. This is important news, the new Customer Duty in the UK is not a rule-based prescriptive approach to specific processes or actions that must be followed. It is outcome-based.

Outcome-based regulations are inherently less clear than detailed rules, and companies maintain some flexibility to choose the best way for them to meet the new set of expectations. With the outcome-based regulation, FCA intends to drive market and technological innovation and fair competition in fast-changing market developments.

Whether or not a product or service delivers good outcomes for customers is not an easy question to answer. Customers can behave irrationally, in a predictable way. Up to 85% of our everyday decisions are irrational with up to 95% of our choices taken subconsciously. So what represents a good outcome and for whom?

Consumers behave predictably irrational

The key word here is predictability. Firms will need to proactively predict how customer decisions are influenced by different designs of their choice architecture. If the choice architecture - in particular in digital channels - promotes good decisions, it is a nudge. If not, the regulator refers to it as a sludge - discouraging good decisions - or as dark patterns - encouraging bad decisions.

Whether or not a service delivers good outcomes for customers is not easy to answer. Sometimes frictions in a customer journey can be even be reasonable and beneficial for customers.

You may not be able to read over 240 pages of feedback to FCA's consultation on the new Consumer Duty, but it is worth a scan. It entails valuable examples of good and poor practices observed in the market. Sludges use friction in the customer journey to prevent consumers from taking actions such as cancelling a product or amending terms.

Like me you have been trapped in sludges for sure, having to

- register and log on to more than one system or platform (for which you are not even registered) to complete an automated journey;

- click on multiple boxes to reveal important text to take an informed decision;

- use a third party tool and wait a day or more before receiving confirmation of a payment plan or if you need to provide further information;

- to contact the carrier by phone if you intend to switch to a different provider. Once on the phone, you undergo a lengthy process during which you are encouraged not to switch.

These types of practices often represent an unreasonable barriers. Evidencing the unreasonable will require A|B testing or sludge audits. However, there are also examples where additional friction would be considered as most reasonable and beneficial for customers. To give you two examples:

- A customer buys a product using your debit card instead of credit card. Adding friction to the customer journey at the sale can raise awareness that using a credit card may have additional protections which could be useful.

- A customer is taking a buy-now-pay-later product which comes at 0% interest over 18 months. The purchase will be linked to being charged default fees, and these can build up to a considerable levels over time. Barriers in the purchasing journey may be reasonable to show the consequences of default when being offered such products. This can decrease the risks of receiving unfair value.

Predictability is the magic word

Aside from the legal debates, the answer around good customer outcomes will come from very practical applications. It will require behavioural economics to analyse how and why customers make decisions in response to the choice architecture presented by the firm. Data science applications can quantify the distribution of outcomes and locate the clusters of customers that are not enjoying the choices made.

To conclude, firms will need to continuously learn from data samples of real customer outcomes. Do consumers pay a price for products and services that represents fair value. Do consumers receive suitable products and services and receive good treatment. Do consumer have the right information to make effective, timely and properly informed decisions about their products and services. Are services accessible and meet diverse consumer needs. Do your employees feel safe to raise issues where the firm may not deliver good customer outcomes? Is your post-sales support as good as your pre-sales?

Outcome-based regulations are more complex to implement

Whilst many firms are investing heavily in customer journey redesign and improved conversion rates, the pursuit of good consumer outcomes, a fair and consumer‑focused playing field, is something very valuable but not so easy to reach.

One critical aspect is that outcome-based regulations are more complex to implement as inherently less clear than detailed rules. They come with lack of legal certainty and may, as a consequence, drive unintended risk aversion. A too cautious approach taken by industry players restrains innovation. It may also limit access to some groups of consumers or the withdrawal of products or services for certain customer segments.

Fair treatment of customers becomes a journey without point of destination. It evolves at fast pace. It must become an integral part of the company culture.

Customer Conduct: a journey without point of destination?

Conduct has recently moved much higher up the regulatory agenda and is now a strategic priority for many supervisory authorities. Putting consumers at the heart of business requires continuous learning and adjusting the course. This is a journey, actually, without a point of destination as consumer behaviours change and evolve concurrently.

Like other global players, AXA gives important guidance and is using frameworks to drive alignment and coherence in Customer Conduct across is organisation. We take a principle-based approach on global level. There is an overriding and prominent conclusion from such efforts: To integrate the fair treatment of customers becomes a journey without point of destination. It evolves at fast pace. In essence, it must become an integral part of the company culture.

FCA's Consumer Duty policy statement, guidance and feedback.

Mirjam Bamberger is member of the Management Committee Europe & Latin America at AXA. Until January 2022, she has been CEO of AXA Luxembourg and CEO of AXA Wealth Europe. Prior to this she served in various roles as a board member of AXA Switzerland, having completed an international trajectory in High Tech and Financial Services across US, Asia and Europe.

The content of this article reflects the opinions of the author concerned and not necessarily those of the AXA Group