AXA’s adventure

Since our inception in 1985, inspired by the vision of Claude Bébéar, we have continually reinvented insurance. Our 40th anniversary celebrates this bold spirit across the world, where each story, individual or collective, pushes the boundaries of insurance. Our adventure is far from over... It continues to be built every day, thanks to AXA's employees committed to protecting what matters.

Discover 40 years of AXA

1958 - 1980

The rise of a small mutual insurer from Normandy

AXA’s origins can be traced back to a small mutual insurer from Normandy: Ancienne Mutuelle de Rouen, created in the early 19th century and specialized in property and casualty insurance.

Key dates

In the post-war period, the insurance industry is struggling. The creation of the French social security system in 1945 deprives mutual insurers of a large part of their business by providing workplace accident and illness cover for workers. However, carefully led by its manager André Sahut d’Izarn, Ancienne Mutuelle emerges from this period in quite a strong position. It even welcomes on board several small regional mutual insurers.

In this environment, the young Claude Bébéar joins the company “a bit by chance” in 1958. Sahut d’Izarn, looking for a future successor, adopts him as his protégé and trains him up on the business’ specific demands.

1968

The inauguration of the new headquarters in Belbeuf

22,000 square meters of extremely modern offices, with construction costs representing almost 10% of the company’s assets! A crazy project, but the stakes are high: Ancienne Mutuelle’s new headquarters in Belbeuf must make it possible to break away from the image of a “small provincial mutual” and empower its employees to dream.

In 2018, after 43 years at this historic site, AXA moves to Isneauville, a few miles away, with offices that are…extremely modern!

1975

1975 Claude Bébéar eventually takes the company’s helm in 1975. He is 40 years old, with a modern vision for insurance and already the firm belief that to be sustainable, it is essential to become international and anticipate societal changes…

1980 - 1990

The bold vision to become a leader

In France, after 25 years in opposition, a left-wing government takes power in 1981. This brings the looming possibility of major nationalization programs targeting private insurance companies.

In the 1980s, after various acquisitions in France, Ancienne Mutuelle de Rouen changed its name to Les Mutuelles Unies and embarked on a mission to bring people together around a shared vision.

The AXA name was created. It was short and simple, legible in every language and appeared at the top of alphabetical lists.

The concept behind the name took shape at an exceptional seminar held in the Ténéré desert in Niger, led by Françoise Colloc’h, an influential figure in the company from her arrival in 1981.

Key dates

Françoise Colloc'h

As an influential figure in the company upon her arrival in 1981, Françoise Colloc’h would serve in several strategic positions to Claude Bébéar, joining the management board in 2000 as director of human resources, brand and communication. A strategic contributor at the founding moments of the AXA brand, Françoise Colloc’h played a key role in devising the Ténéré desert seminar and then in choosing the new name and creating the AXA logo. It was Françoise Colloc’h who devised the graphic identity that is now recognised all over the world. The intention was to reflect the brand’s dynamic drive, modernity and international universality. The logo has changed very little since its creation and appears timeless.

From 1982 to 1989, three successive acquisitions make AXA the No. 2 insurancecompany in France behind UAP.

However, in 1986, the saying “three’s a crowd” proves right as disputes start to flare up between Drouot, Mutuelles Unies and Présence, as each of the Group’s components looks to take center stage. To bring everyone on board for the strategy, Claude Bébéar and Françoise Colloc’h take all the executives off to the Ténéré Desert. This shared experience paves the way for a truly united group and support for one single name: AXA.

1990 - 2000

AXA, a world leader for insurance

The early 90s are marked by three main events: the fall of the Berlin Wall, the Gulf War and a major economic recession. This challenging period also opens opportunities for those who know how to capitalize on them.

Key dates

AXA Hearts in Action

Founded in 1991 by Claude Bébéar, AXA Atout Coeur (known as “Hearts in Action” in English) reflects a deep conviction that companies can and must play an active role in the community. Above and beyond their purpose and core business, companies must make a contribution to society by serving the interests of all, especially the most vulnerable. Claude Bébéar brought his vision to life by setting up this charity. Since its inception, the charity has given all staff members the opportunity to serve others, while getting involved in a cause that is important to them, and thus contributing to a fairer and more sustainable world. Today, AXA Hearts in Action is present in all the geographical regions where the Group operates, and has carried out over 30,000 volunteering actions, with more than 950 solidarity initiatives throughout the world and 251 partner charities.

In 1991, AXA acquires the US firm Equitable. With this acquisition, AXA establishes itself as a leading international group.

The second key milestone from this decade takes place five years later. To widespread surprise, AXA “absorbs” UAP, which is twice its size. This deal creates France’s number 1 and the world’s number 2 insurer.

AXA follows this with a series of acquisitions, buying out the Japanese company Nippon Dantai and taking over Guardian Royal Exchange, enabling it to strengthen its presence in 15 countries and move into the health segment through its subsidiary PPP Healthcare. The Group continues to invest in health then in research for collective progress by protecting what is most essential for people: their health.

At the dawn of the new millennium, AXA becomes a global leader. More than ever, its success is built around a shared culture.

“A shared culture is essential for developing a shared economic adventure.”

Claude Bébéar

2000 - 2016

Putting Safeguards in place to protect AXA from successive crisis

When Henri de Castries took over the reins of AXA in 2000, the company faced a series of crises: the bursting of the dot-com bubble, the 9-11 terrorist attacks, the Eurozone crisis, earthquakes in Japan, and so on. Henri de Castries focused on strengthening the organization, in particular, by reinforcing its risk control strategy, in order to weather the storm.

Key dates

In this volatile environment, AXA remains convinced of the importance of its long-term commitments to its customers and society in general. In line with this spirit, AXA launches the AXA Research Fund to improve the understanding and prevention of major risks around the world. The AXA Research Fund further enhances the wide range of initiatives in place across the Group, which is committed to acting on what counts for communities. Created out of the belief that science has a key role to play in meeting society’s major challenges, AXA sets out its commitment to help drive collective progress by supporting research projects focused on health, environment and socio-economics.

AXA Research Fund

The AXA Research Fund, a global scientific philanthropy initiative, was set up in 2008, under the direction of its then-CEO, Henri de Castries. Its mission was clear from the outset: accelerate scientific progress to better address the major risks facing our planet. Through its unique strategy for action, the Fund supports and disseminates innovative research on health, the climate and socio economics, and facilitates exchange between the insurance industry and the academic world.

2016 - 2024

Insurance at the forefront to face new risks

Thomas Buberl took the helm at AXA in September 2016.

As the first non-French CEO, he embarked on an ambitious transformation, by streamlining the company's activities, refocusing its strategy and expanding into growth areas such as health insurance and personal protection.

In 2018, with the aquizition of the XL Group, AXA strengthens its position in corporate insurance and complex risk management. Through this acquisition, along with the IPO of the US subsidiary AXA Equitable Holdings, the Group redefined its business portfolio, making AXA the world's leading provider of property and casualty insurance for business customers.

Key dates

In 2020, the Group sets out its vision to "Act for Human Progress by Protecting What Matters". Thomas Buberl thus made human progress the central focus of the 'Driving Progress' strategic plan and integrated environmental, social and governance (ESG) criteria into strategic decision-making.

With new and interrelated risks emerging, the 'Unlock the Future' roadmap was developed to address economic, social, and environmental challenges.

To mitigate these risks, Thomas Buberl expanded AXA's operations in climate and cyber insurance for businesses and emphasized the importance of collaboration between private and public stakeholders to develop effective solutions.

“Our mission is to protect what matters, today and for future generations.”

Thomas Buberl

CEO

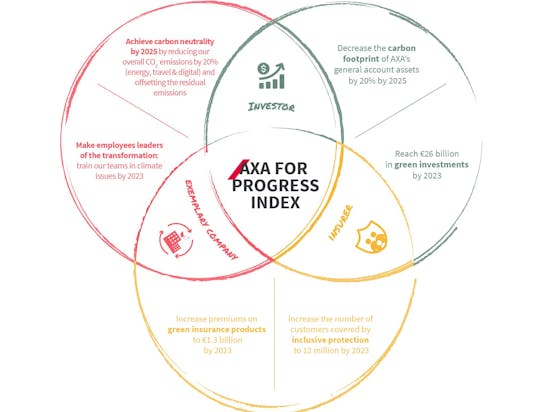

AXA for Progress Index

In 2021, AXA launches its “AXA for progress index” to monitor its ESG engagements. This index, built around 7 commitments, was designed to measure the progress of AXA’s sustainability strategy and to reinforce its threefold impact for the insurer, the investor, and the exemplary company. These commitments, monitored through the AXA for Progress Index, are inspired by AXA’s purpose to “Act for human progress by protecting what matters” and aligned with its “Driving Progress 2023” strategic plan.

Unlock the Future

Launched in 2024, AXA's "Unlock the Future" strategic plan focuses on growing and strengthening core businesses while ensuring rigorous execution. The plan aims to enhance organic growth and operational excellence across all sectors, including Property & Casualty and Employee Benefits. It sets ambitious financial objectives for 2024-2026, emphasizing a disciplined approach to strategy implementation.