Investors

Taxation and wealth management

AXA offers you an overview of the applicable tax regimes in respect of capital gain and dividend. We also invite you to contact your tax advisor and consult the information shared by your residential country’s financial authorities.

What is the tax regime applicable to dividends (outside PEA*) received by French tax residents?

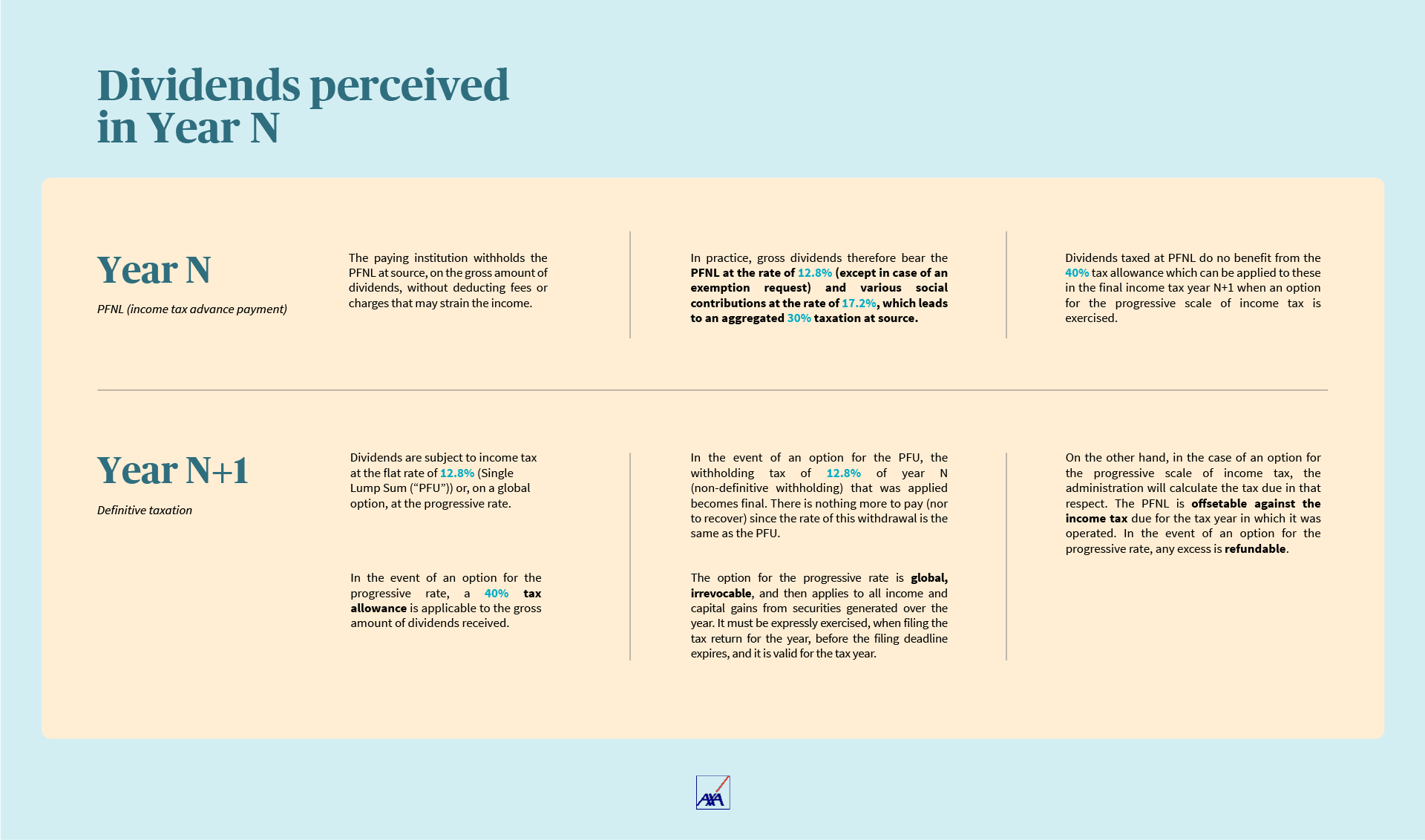

Taxation of dividends (and similar income) received by individuals is carried out in two stages:

- The year of their payment (year N): the dividends are subject to a non-discharging 12.8% withholding tax at source (Prélèvement Forfaitaire Non Libératoire[1] (

PFNL

) paid as an advance payment - The following year (year N+1): they are subject to income tax minus PFNL deduction

Dividends are also subject to social contributions at the rate of 17.2% (9.9% CSG, 0.5% CRDS, 4.5% social contributions, 0.3% additional contribution and 2% solidarity contribution) on their gross amount. Which, added to the 12.8% withholding tax, leads to an aggregated 30% taxation at source (the PFU

).

What is the applicable tax regime to French tax residents in the event of gain realised on a sale of AXA shares (outside PEA)?

The capital gain on the sale made as part of the management of private assets must be reported in the overall income statement for the year (n°.2042/2021C) in the category gains from the sales of securities.

The realized capital gain is subject to income tax at the single flat rate of 12.8% to which are added social contributions for an aggregated rate of 17.20% (so an overall taxation of 30%).

However, it is possible to opt for the progressive rate (global option). The taxable capital gain must then be added to other income when filing the income tax return. The overall amount is then subject to the progressive rate of income tax and social contributions of 17.20%.

Note: in practice, individual taxpayers are taxed for capital gains on securities and partnership interest on their net gain realized over the tax year.

- To determine the taxable capital gain or capital loss carryforward for a year, it is first necessary to calculate, for each sale, the net gain realized by the difference between the selling price and the acquisition price

- The net taxable gain is determined after deducting, where applicable, from the realized capital gain, losses of the same nature generated during the same year or carried forward. Capital losses are taken into account as follows:

- Capital losses suffered during a year are offsetable exclusively against capital gains of the same taxable nature generated during the same tax year

- In the event of an overall annual loss, the remainder of the non-offset losses is carried-forward and is offsetable under the same conditions for the following ten years

- In the event of an overall annual capital gain, the balance can be reduced (within the limit of its amount) by carried forward capital losses (and still offsetable) from previous years, the oldest being offset as a priority - When the global option for income taxation according to the progressive scale is applied, capital gains on the sale of securities acquired before January 1st, 2018 and remaining after the offsetting of the capital losses realized during the tax year and those carried forward from the previous years, can be reduced by a proportional allowance for a holding period

What is the tax regime applicable to AXA shares held in a PEA?

The Share Savings Plan (PEA) allows you to invest in shares while benefiting, under certain conditions, from tax exemption on dividends and capital gains, provided that no withdrawals are made for five years. AXA shares are eligible to PEA.

Only adult individuals whose tax residency State is France are entitled to open a PEA. Payments to a classic PEA must be made in cash contribution (capped at 150 000 euros), knowing that gains generated within a PEA are not deemed as cash contributions.

It can only be opened one PEA per person.

No minimum or maximum duration is set by law for the PEA, but if it is closed before five years, the holder is taxed on the net capital gain generated since the PEA opening.

Income and capital gains from investments made within the framework of a PEA are exempt from income tax. This exemption is normally acquired only if no withdrawal has taken place from the PEA for a period of five years from the first contribution. The capital losses incurred are neither offsetable nor carried forward against capital gains of the same nature which would be realized outside the PEA.

The tax regime for income and capital gains realized within the framework of a PEA depends on the time passed between the date of withdrawal (or closure) of this PEA and the first contribution (apart from special cases fixed by law):

- After five years as from the date of the first cash contribution into the PEA:

- Partial withdrawals do not trigger the PEA closure. The income and capital gains generated by the investments realized through a PEA are income tax free (i.e. no income tax). The PEA holder is still allowed to contribute additional cash into his PEA within the limits of the legal restrictions

- The withdrawal of all sums or values triggers the PEA closure - Except in special cases, withdrawals which take place before the end of the fifth year of the operation of the PEA lead in principle to the closure of the plan. The net gain realized since the PEA opening is then taxed under the condition of common law (namely, Single Lump Sum (PFU) of 12.8% or on the global option of the taxpayer concerned, progressive scale of the income tax)

Whatever the date of the withdrawals, the gains generated within a PEA are subject to various social contributions whose rates depend on the date of the PEA opening.

- For the PEAs opened on or after January 1st, 2018, the rate of social contributions is the one in force for on the day of the withdrawals (17.2% in 2022)

- For PEAs opened between January 1st, 2013 and December 31st, 2017:

At the PEA exit, the gains realized over the 5 first years as from the PEA opening will be subject to the so-calledhistorical rates

rule. For gains acquired or generated after 5 years of holding period, they will be subject to the rate rule in force on the day of withdrawal

The rule ofhistorical rates

implies to make a complex calculation, by reconstituting the gains made or generated each year within the PEA and by applying the rate of social contribution in force that year - For PEAs opened before January 1st, 2013:

All the gains acquired or realized up to December 31st, 2017 are subject to the rule ofhistorical rates

. Then, it is the rule of the rate in force on the day of the withdrawal that applies for gains acquired or recorded as from January 1st, 2018

What is the tax regime applicable to French source dividends received by non-French tax resident individuals?

AXA SA being a French company, the dividends it distributes are in principle subject to withholding tax (except in cases of exemption provided for by the French law) in France.

For individual beneficiaries**, the rate of withholding tax is set at 12.8% (subject to the application of an international tax convention providing for a more favorable withholding tax rate). It has to be noted that the French paying institution in charge of paying these dividends will only be able to apply this withholding tax rate (or the conventional rate if more favorable depending on the circumstances), if the corresponding bank account has been duly documented allowing it to know in particular the identity (including his capacity as an individual) and the tax residence country of the said account holder.

When the paying institution is not able to identify the effective beneficiary (i.e. when the institutions which manage abroad the securities accounts of a non-resident effective beneficiary have not provided the paying institution with the required information for the application of the rate of 12.8% or the conventional rate if more favorable), the rate of 25% is applied by default.

In the case a non-French resident individual shareholder has not been in position to benefit from the 12,8% withholding tax rate at the time of the dividends distribution (or the conventional rate if more favorable), he can request the reimbursement of the overpayment from the French Treasury. For this, he should use the following forms:

1. Form 5000 relating to the certificate of tax residence, available in several languages: German (form 5000-DE-SD), English (form 5000-EN-SD), Spanish (form 5000-ES-SD), French (form 5000-FR-SD), Italian (form 5000-IT-SD), Japanese (form 5000-CN-SD), Dutch (form 5000-NL-SD)

2. Form 5001 relating to the calculation of the withholding tax and the refund of the tax credit, available in several languages: German (form 5001-DE-SD), English (form 5001-EN-SD), Spanish (form 5001-ES-SD), French (form 5001-FR-SD), Italian (form 5001-IT-SD), Japanese (form 5001-CN-SD), Dutch (form 5001-NL-SD)

In order to help applicants to complete the forms and the procedures to follow, an explanatory notice is made available by the French tax authorities. This notice is also available in several languages: German (form 5000NOT-DE-SD), English (form 5000NOT-EN-SD), Spanish (form 5000NOT-ES-SD), French (form 5000NOT-FR-SD), Italian (form 5000NOT-IT-SD), Japanese (form 5000NOT-CN-SD), Dutch (form 5000NOT-NL-SD)

These forms can be obtained:

- From the tax authorities in your country of residence

- From the non-resident tax center : Centre des Impôts des non-résidents, 10 rue de Centre, 93465 Noisy Le Grand, France

- On the website of the French tax authorities: www.impots.gouv.fr.

DISCLAIMER: The information contained in the Taxation and transmission of assets

(Fiscalité et transmission de patrimoine

) page is only for informational purposes and does not constitute tax advice on the basis of which an action or a decision can be implemented. Tax laws can be subject to frequent changes. For any questions, the tax administration or your tax advisor is your privileged contact.

* Taxpayers whose income tax reference does not exceed €50 000 (single, divorced, or widowed) or €75 000 (taxpayers subject to common taxation) can apply to be exempted from PFNL. This request must be made expressly under the conditions provided by Article 242 quater of the General Tax Code. Even in the event of an exemption from PFNL, social contributions remain due.

** Whose bank account is not located in a State or a territory considered as non-cooperative

, as defined under French tax law.

Contacts

Individual Shareholders Relations

Phone (from outside France)

email