Sustainability

AXA EssentiALL: Inclusive insurance

Empowering customers living on modest incomes around the globe to better protect their families, businesses and communities.

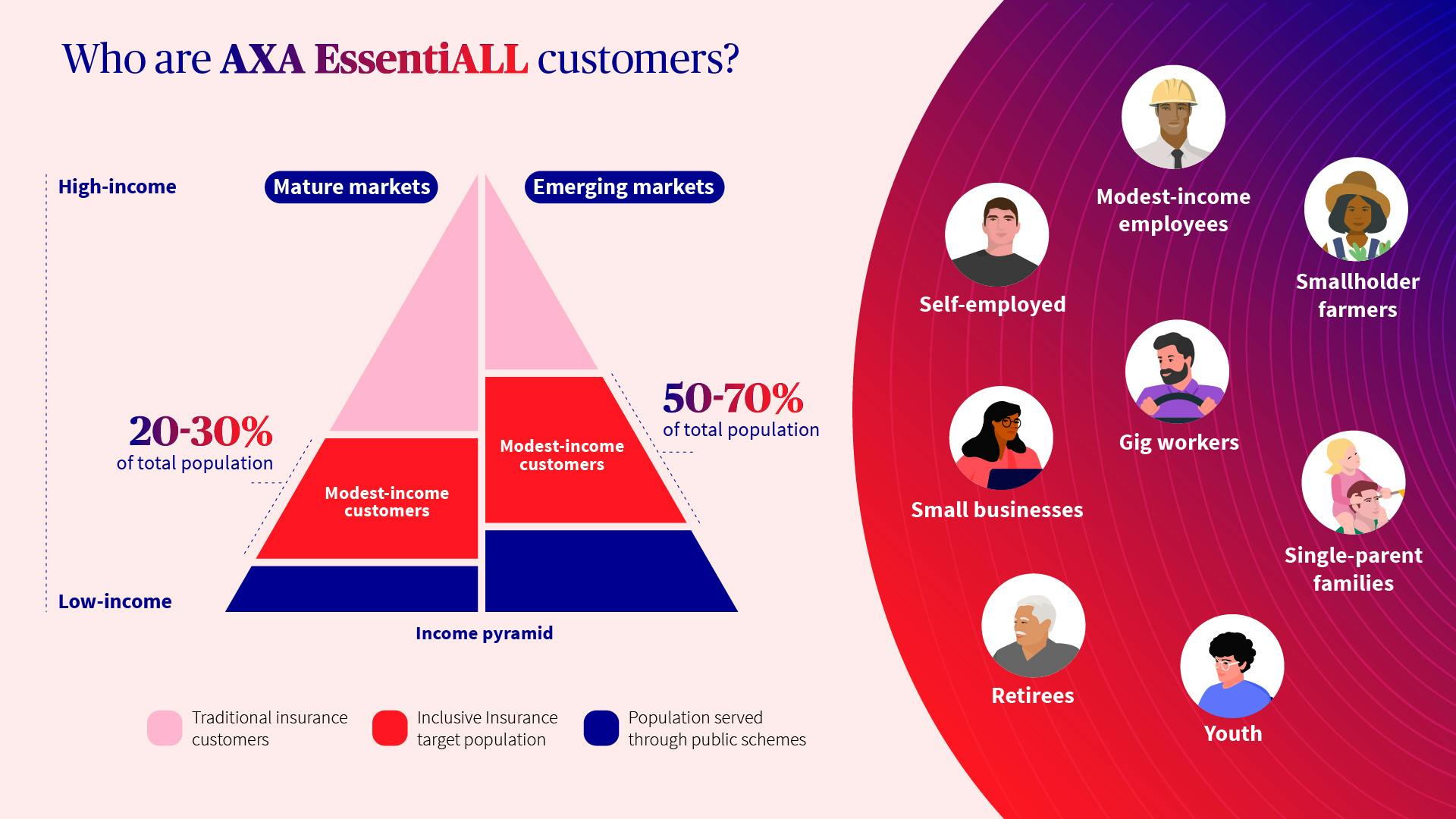

Determined to be an insurer with a positive impact, AXA continues to take action to reduce insurance inequalities around the world. Indeed, 70% of the population in emerging economies and over a quarter of Europeans are either unable or no longer able to access insurance products and services. As a leading global insurer, we are determined to address this protection gap affecting modest-income customers, who are increasingly vulnerable to risks, through inclusive insurance.

Meet Héctor, one of AXA EssentiALL customers from Colombia

AXA EssentiALL brings inclusive insurance to modest-income customers across 21 countries, in both mature and emerging markets. Our customers are small business owners, gig workers, farmers, young people and retirees. What they have in common is that they have to navigate their daily lives on limited or highly volatile incomes making them even more vulnerable when facing unexpected shocks in their families, communities or work. Damage to a vehicle can put a gig worker’s livelihood on the line, and medical emergencies frequently force families to take on debt they struggle to afford.

Helping customers manage these risks requires reinventing the way we do insurance and AXA has been doing so for almost a decade. AXA launched its inclusive insurance business unit in 2016, originally named AXA Emerging Customers, to cover the essential insurance needs of low- to middle-income households and small businesses in emerging markets. In 2024, under the new name ‘AXA EssentiALL’, it extended its geographical scope to Europe in response to an increasing need: families on modest incomes are facing higher degrees of uncertainty, decreasing purchasing power and declining standards of living.

Today, AXA is the only global insurer committed to inclusive insurance in both emerging and European markets. AXA EssentiALL inclusive insurance is a sustainable and a profitable business at the heart of AXA’s 2024-2026 strategic plan, Unlock the Future

.

Key figures for 2024

Ambition for 2026: Over 20 million customers

Insurance is the only financial service fully dedicated to managing unexpected shocks - shocks that often push modest populations into poverty or prevent them from ascending the socio-economic ladder. Through its insight-based offerings, AXA EssentiALL empowers customers with modest revenues worldwide - individuals and businesses alike - in order to help them make ends meet at the end of the month. In other words, contributes to securing their financial health.

Reinventing insurance: An inclusive business model in practice

Adapting insurance to the needs of modest-income customers requires reinventing our business model to overcome the barriers faced by our customers. These include high costs and a lack of access, as well as limited understanding and trust in insurance. To do so, we provide solutions that are:

Attractive: inclusive insurance solutions are designed to meet the needs and aspirations of our customer segments. The customer journey from policy issuance to claims is adapted to the segment’s preferences – whether physical, digital, or both – offering simplicity and convenience.

Accessible: we distribute inclusive insurance products through channels that are trusted by modest-income customers and micro-businesses. These include microfinance institutions, small banks, farmer cooperatives, mobile phone network operators, digital payment companies, retailers but also employers and public-private partnerships.

Affordable: focused on clients’ essential needs, taking out unnecessary requirements, while introducing flexible payment facilities compatible with customers’ cash flows.

Propositions are co-created with customers and distributors to ensure that both the product and delivery method are tailored to customer needs. The distribution strategy is defined for each market based on local market practices and AXA’s positioning. By doing so, we can reach communities with modest incomes, enabling them to build resilience and work towards improved financial health.

AXA’s inclusive insurance business at a glance

Our customers face a wide range of risks to their lives, families and businesses. AXA EssentiALL develops insurance solutions designed to meet their essential needs:

- Protecting our customers and their families (Protection and Health) - 61% of AXA EssentiALL customers (10.5 million)

Protection insurance solutions are life insurance products covering the family livelihood in case of death, accidents, or disability of a breadwinner. Health insurance aims at limiting out-of-pocket expenses and compensating the loss of income derived from unexpected health-related conditions. In several markets we provide additional services that help customers manage their everyday health needs.

For example, since 2021, AXA has offered insurance with Banco Mundo Mujer (BMM) in Colombia to protect over 600,000 micro and small businesses mainly run by women who took loans with the bank to grow their business. The insurance protects them in the event of accidental death or disability, as well as certain critical illnesses. It also provides telephone medical assistance for customers. AXA EssentiALL and BMM work together to continue promoting insurance as an instrument for financial inclusion and resilience in the country. Our partnership with BMM also includes the development and provision of additional voluntary protection solutions designed on customers needs, such as life and disability protection for the co-debtors of the loans who are usually important family members, friends or business partners of BMM customers. - Protecting our clients’ critical productive assets, such as shops, motorbikes and crops, to sustain their families’ livelihoods (Property & Casualty products) - 33% of customers (5.8 million)

Property & Casualty products are vital to secure customers’ main source of income and sustain their livelihoods. These products provide business owners with emergency cash if business-related assets are damaged due to fire, natural disasters, and other incidents.

Under AXA EssentiALL’s flagship segments for 2024 and 2025, micro-entrepreneurs are a top priority, both in Emerging and European markets. AXA France, for example, launchedMy Entrepreneur Pack

, the first all-in-one, affordable solution designed specifically for micro-entrepreneurs in the country. This innovative bundling approach offers protection against key risks (life, accidents, protection of assets, business interruption and legal advice) and is sold through our largest agent network, with over 2,700 policies signed in 2024. - Developing tailored product bundles to provide accessible, affordable and adaptable solutions for clients (Bundled products) - 6% of customers (1.1 million)

Based on customers’ needs, AXA EssentiALL designs solutions that protect customers against a combination of risks.

In Morocco, for example, we offer a product to support small business owners and their families to repay a business loan in the event of death and protect the family business against fire and theft.

In Côte d'Ivoire, AXA offers insurance to around 44,000 rice farmers to protect their crop against extreme weather. The product, designed by AXA Climate, is index-based, covering drought and excess rainfall.

Of policies in force

AXA EssentiALL recognizes that providing inclusive insurance solutions is not only about the economic compensation, but also about accompanying customers throughout their insurance coverage period, to provide additional services and enhance the value provided to these groups.

As a business with social impact, AXA EssentiALL aims to provide attractive, accessible, and affordable products to underserved communities in our markets in order to ensure their financial health and sustained growth even in the face of unexpected events.

AXA EssentiALL’s vision is to build a financially viable business, with a relevant positive impact on customers. This is why we measure the customer centricity of our products (e.g., simplification of terms and conditions, easier claims processes) and collect social indicators as much as possible.

In addition, we work with partners to conduct impact measurement research. By collaborating with these partners locally, we reach out to customers directly to understand how our solutions are supporting their household finances in the face of unexpected events, how they would cope with those shocks with or without insurance, and how we can foster an insurance culture. This evaluation helps inform further product improvements and developments and is a first step in an internal approach to measuring the effects that insurance can have within communities.

Contributing to a Fair and Inclusive transition

Populations living on modest incomes face increasing risks due to the impacts of climate change, coupled with the rising costs of climate adaptation. Farmers are losing their crops, fishermen are getting injured during extreme weather events, and individuals are struggling to work in extreme heat. All of these factors result in lost income. It is estimated that more than 100 million people will be pushed into extreme poverty by 2030 due to climate change, while more than 200 million people could be displaced by more frequent and severe climate disasters.

Jean Jouzel

Previous Vice-President of the GIEC (Group 1)

One of the first consequences of climate change is increasing inequalities globally.

AXA’s vision is to support the transition to a low-carbon and less resource-intensive economy that also fosters inclusion, resilience and climate adaptation, including for low- and middle-income populations. By helping individuals and businesses cope with shocks, insurance is an important tool to create resilience and bring about a fair and inclusive transition globally.

In Indonesia, for example, the livelihoods of smallholder farmers are severely impacted by recurring extreme events like floods and droughts, as well as long-term changes in rainfall patterns and increasing temperatures linked to climate change. Since 2022, AXA has been working in partnership with the InsuResilience Solutions Fund, AXA Climate and two Indonesian agribusiness partners to test a parametric insurance product protecting corn and rice farmers in several provinces. The product aims to give smallholder farmers rapid access to funds in the case of severe drought or excessive rainfall, without the need for individual assessments of damage.

A strong leadership voice

For inclusive insurance to effectively contribute to sustainable development, cooperation is needed among a range of public and private actors to find and offer new ways to manage risks. AXA EssentiALL partners with organizations and consortia that share our vision and values and is active in the financial inclusion community. Its partners include the Insurance Development Forum (IDF), where AXA EssentiALL co-chairs the Inclusive Insurance Working Group, and the Microinsurance Network (MiN), where it contributes to the Landscape of Microinsurance, an annual study of the inclusive insurance industry. In China, AXA EssentiALL collaborated with the Chinese Academy of Financial Inclusion (CAFI) in launching a research partnership to understand the financial lives of low-income households.

- Landscape of Microinsurance

- Understanding the financial lives of low-income households in China

- The Universal Postal Union (UPU) and AXA Join Forces to Advance Inclusive Insurance through Postal Networks

In 2024, AXA became the first private sector member and strategic partner of CGAP, the consultative group for assisting the poor, housed at the World Bank, an important step to ensure public and private stakeholders collaborate and work together to improve the financial health of underserved customers.

Related content

AXA EssentiALL has also partnered with the Universal Postal Union (UPU) to advance inclusive insurance distribution through postal networks, which are critical to reach the most vulnerable and remote populations in different countries. AXA is in the process of creating Egypt’s first micro-insurance company with Egypt Post investment leveraging its 4000+ branches across the country to provide attractive, affordable and accessible protection to retail customers across the country. In Spain, AXA also partnered with Correos leveraging its extensive distribution network of 8,500 post offices in both urban and rural areas across the country to help better protect entrepreneurs, families, and underserved communities.

Governance

AXA EssentiALL, as the dedicated business unit in charge of executing AXA’s commitment to financial inclusion, reports directly to the Deputy CEO of AXA Group. Its performance is overseen by an Inclusive Insurance Steering Committee set up with key AXA Management Committee members across all AXA geographies (Emerging markets and European markets, including France). The Compensation, Governance & Sustainability Committee reviews, at least once a year, the Group’s sustainability strategy (including AXA EssentiALL’s ambition and performance) as well as material sustainability-related commitments disclosed publicly and reports to the Board of Directors in this regard.

On top of these efforts, AXA EssentiALL is committed to AXA's strong Code of Ethics. AXA’s code of conduct includes, for example, a commitment to never providing false information to clients, business partners, and competitors. Through these commitments, we ensure customers are treated fairly and professionally, limiting aggressive sales techniques and promoting responsible practices.

In 2024, AXA EssentiALL’s strategy was selected as one of the 27 sustainability topics deemed material for AXA (Impacts, Risks and Opportunities i.e. IROs) as part of AXA’s first Corporate Sustainability Reporting Directive (CSRD) exercise, reinforcing AXA’s long-term public commitment to financial inclusion. It is considered to have a positive impact on closing the protection gap for populations that are un- or under-served by insurance products and services. To reflect the social component of the AXA EssentiALL business, the selected indicator for this IRO corresponds to the number of customers served by inclusive insurance solutions.

Contacts

AXA EssentiALL

Contact Email