Sustainability

AXA for Progress Index

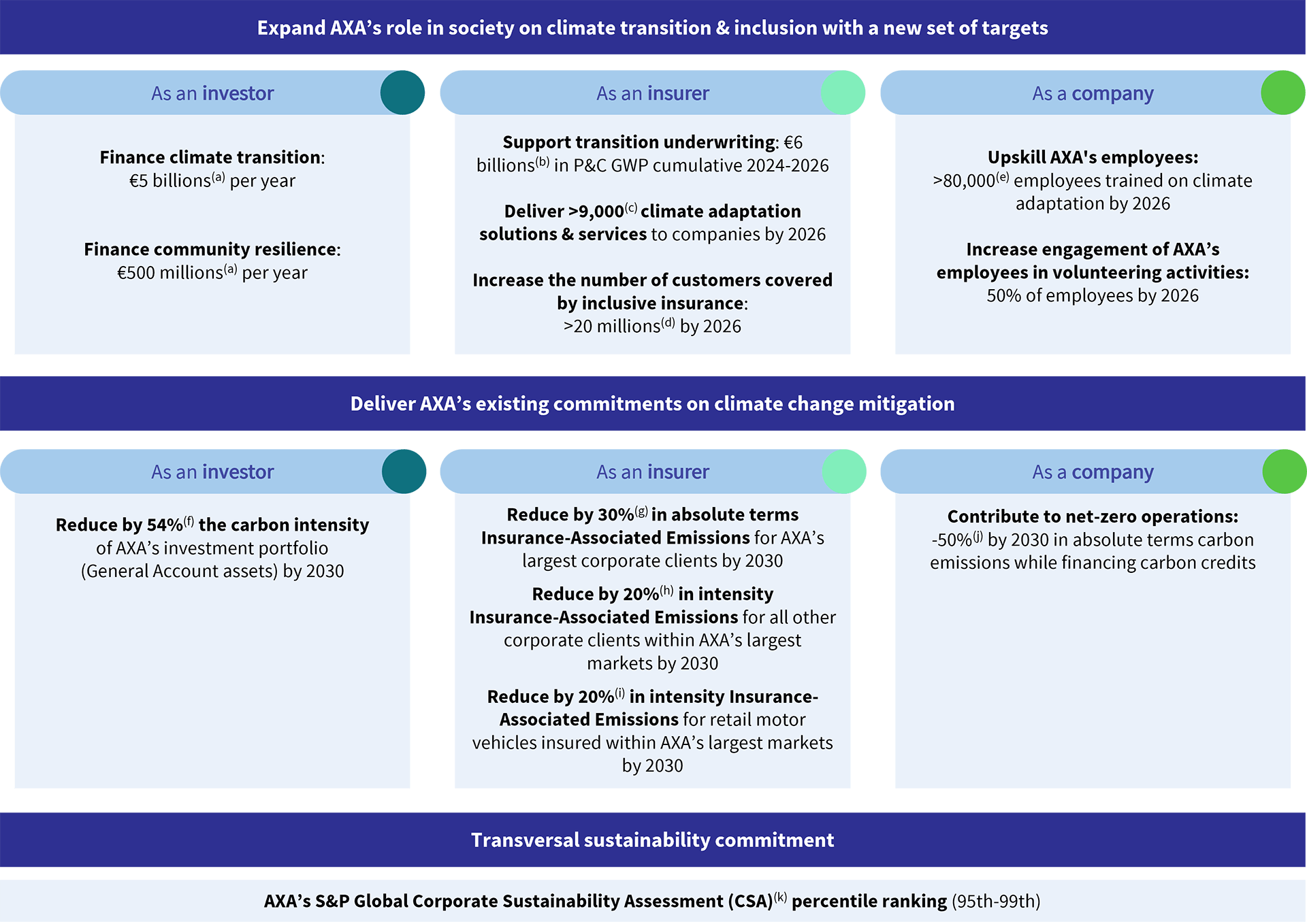

Since 2021, AXA has implemented a set of strategic key performance indicators, the AXA for Progress Index

.

This tool is designed to integrate sustainability and monitor AXA’s sustainability strategy across its activities:

- as an investor;

- as an insurer;

- as a company.

These measurable commitments are inspired by AXA’s purpose Act for human progress by protecting what matters

.

During its 2024 Annual Shareholders’ Meeting, AXA presented the second edition of the AXA for Progress Index

, highlighting (i) a new set of strategic targets aligned with the 2024‑2026 Group strategic plan Unlock the Future

, (ii) its commitment to meeting its 2030 decarbonization targets which are set in line with industry standards ; and (iii) AXA’s extra‑financial performance leveraging S&P Global Corporate Sustainability Assessment, an internationally recognized methodology.

| Targets | Unit | 2024 Result | Target | Timeline |

|---|---|---|---|---|

| Climate transition financing (a) | Euro billion | 7 | 5 | Annually through 2030 |

| Community resilience financing (a) | Euro billion | 1.3 | 0.5 | Annually through 2030 |

| P&C GWP to support transition underwriting (b) | Euro billion | 2.1 | 6.0 | Cumulative 2024-2026 |

| Number of climate adaptation solutions & services to customers (c) | Number of solutions | 1,052 | >9,000 | Cumulative 2024-2026 |

| Number of customers covered by inclusive insurance (d) | Millions of customers | 17.4 | 20 | 2026 |

| Number AXA's employees trained on climate adaptation (e) | Number of employees | n/a | >80,000 | Cumulative 2024-2026 |

| Percentage of AXA's employees engaged in volunteering activities | Percentage of employees | 40% | 50% | 2026 |

| Carbon intensity of AXA's investment portfolio (General Account assets) (f) | Variation against 2019 baseline in % | -50% | -50% | 2019-2030 |

| Absolute Insurance Associated Emissions for AXA’s largest corporate clients (g) | Variation against 2021 baseline in % | -25% | -30% | 2021-2030 |

| Insurance Associated Emissions intensity for all other corporate clients within AXA's largest markets (h) | Variation against 2021 baseline in % | -7% | -20% | 2021-2030 |

| Insurance Associated Emissions intensity for retail motor vehicles insured within AXA's largest markets (i) | Variation against 2019 baseline in % | -11% | -20% | 2019-2030 |

| Absolute carbon emissions of AXA's own operations (j) | Variation against 2019 baseline in % | -38% | -50% | 2019-2030 |

| AXA’s ranking in S&P Global Corporate Sustainability Assessment (CSA) (k) | Percentile ranking in CSA | 98th | 95th-99th | Annually |

n/a: not available. (a) Scope: corporate and sovereign debt, real estate and private assets. Timeframe: per annum through 2030. (b) Scope: AXA France, AXA Germany, AXA Switzerland, AXA UK, AXA Belgium, AXA Hong Kong, AXA Mexico, and AXA XL. Timeframe: cumulative 2024‑2026. (c) Scope: Commercial lines portfolios of AXA France, AXA Germany, AXA Switzerland, AXA UK, AXA Belgium, AXA Hong Kong, AXA Mexico and AXA XL. Timeframe: cumulative 2024‑2026. (d) Solutions following AXA EssentiALL’s principles of Inclusive Insurance, aiming to serve low income to mass market segments in emerging markets, and modest income segments in mature markets. (e) Number of employees who have been trained on climate change adaptation, completing a training under the AXA Sustainability Academy. (f) Variation of the Enterprise Value including Cash (EVIC)-based carbon intensity (Scope 1 and 2) of AXA Group's General Account assets between FY2019 and FY2029. The scope of the 2024 results covers listed corporate debt and equity, and real estate equity. Based on the progress achieved, AXA published in September 2025 a revised decarbonization target aiming for a 54% reduction by 2030, along with an extension of the scope to include infrastructure assets, representing in total €182bn as of FY2024, equivalent to 39% of the General Account. Unit: tCO₂ eq/ Euro. millions. (g) Calculated on CO₂ eq (Scopes1 and 2) of AXA’s 88 largest global commercial clients; only insurance lines of business in scope of the Partnership for Carbon Accounting Financials (PCAF), namely the PCAF Standard Part C published in 2023, excluding facultative reinsurance. Unit: absolute Insurance Associated Emissions (IAE). Timeframe: 20212030. (h) Scope: Commercial lines portfolios of AXA XL, AXA France and AXA Germany. Unit: Insurance Associated Emissions (IAE)/Gross Written Premium (GWP). Timeframe: 20212030. Calculated on CO₂ eq (Scopes 1 and 2) of insurance lines of business in scope of the PCAF Standard Part C published in 2023, excluding facultative reinsurance. (i) Scope: Personal lines retail motor portfolios of AXA France, AXA Germany, AXA Switzerland and AXA UK. Unit: Insurance Associated Emissions (IAE)/vehicle. Timeframe: 20192030. Calculated on CO₂ eq (Scopes 1 and 2) of passenger vehicles as described in the PCAF Standard Part C published in 2023. (j) Variation of AXA Group's absolute carbon emissions (scope: energy Scopes 1 and 2, car fleet and business travel). Unit: t CO eq. Timeframe: 20192030. Financed carbon credits correspond to the non abated emissions from the aforementioned scopes. (k) The S&P Global CSA enables companies to benchmark their performance on a wide range of industry specific economic, environmental and social criteria. The output of CSA underpins the world’s most renowned sustainability indices, the Dow Jones Best in Class Indices.