9

February 2016

AXA and socially responsible insurance

Starting time: 7:30 PM CET

Ending time: 9:30 PM CET

Reserved exclusively to members of the Shareholders' Circle depending on the available slots.

On February 9, AXA’s individual shareholders were invited to a thematic conference on responsible insurance and AXA, presented by Céline Soubranne, Head of Corporate Social Responsibility at AXA France, and Philippe Moati, professor of economics and co-founder of the Observatoire Société et Consommation

.

Céline Soubranne’s introduction repositioned the concept of responsible insurance in the general context of the 20th century: from the first signs of environmental awareness to the theorization of sustainable economic growth. This was also an opportunity to highlight that social, environmental and societal commitments have been an integral part of AXA’s genetic make-up since the creation of IMS-Entreprendre pour la Cité by Claude Bébéar in 1986.

Philippe Moati then presented a new model for consumption, built around the sharing and collaborative economy in particular, as seen today in the practices of new accommodation or transport firms such as Airbnb and BlaBlaCar. According to recent research, the reasons for this change are both economic, in a challenging environment, and technological, linked to the digital revolution, while focusing back in on the concerns of consumers, who are disappointed by their conventional consumption practices and want to adopt a more meaningful way of consuming. Ecological and socially responsible expectations are emerging among French people who want a better way of consuming and are particularly concerned with civic responsibility, the environment and energy consumption*.

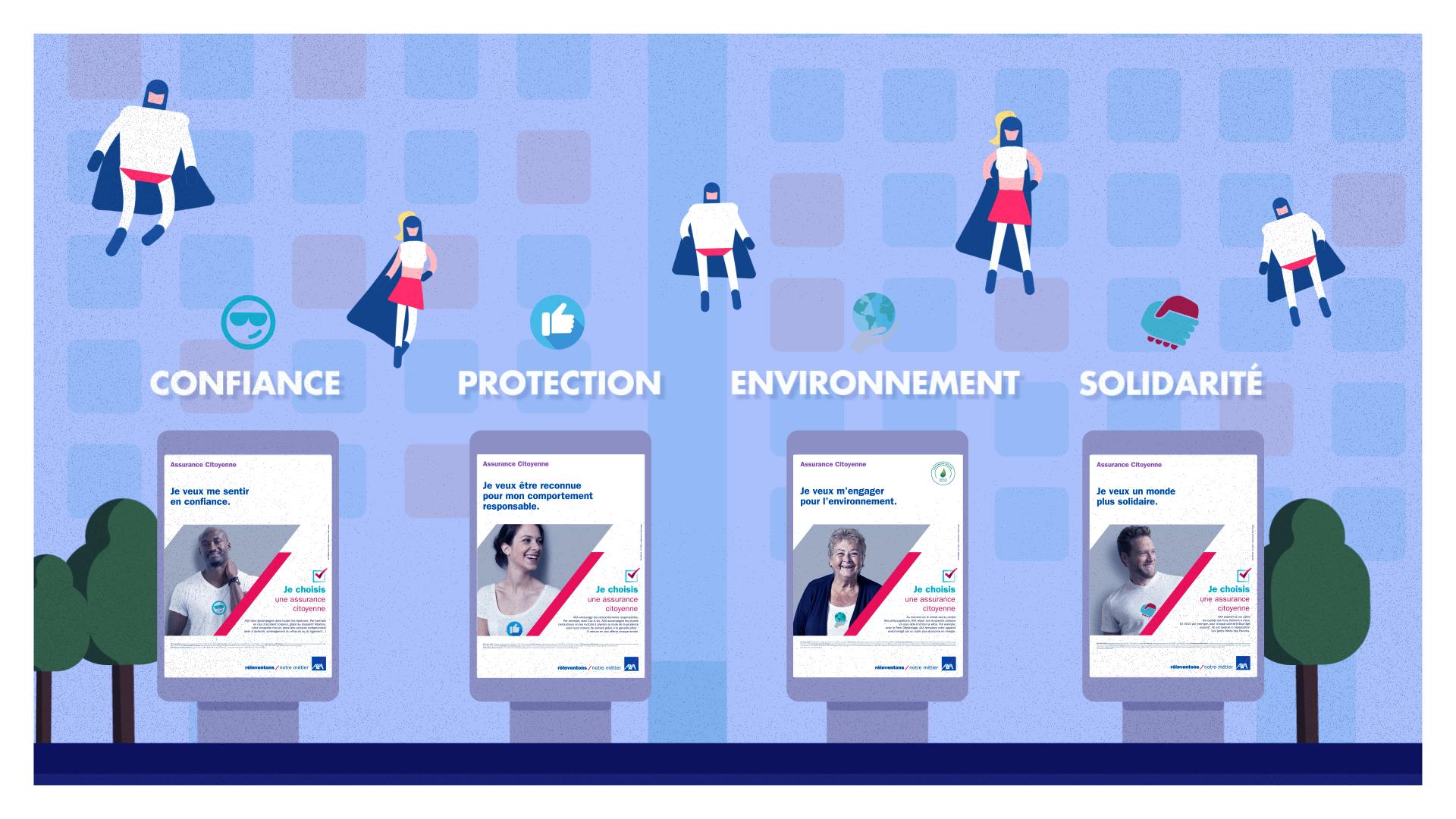

Céline Soubranne then presented AXA France’s recent response to these issues: the Assurance Citoyenne

program. The creation of a framework for assessment, with help from demanding external stakeholders and independent certification, means that we now have one dedicated tool. To support this approach, four commitments have been incorporated into new products since the end of 2015, in line with customers’ focus on meaningful solutions:

- Knowing and understanding what we are buying, to reestablish confidence and trust, for instance with a comparison site for motor insurance, including cover and exclusions.

- Creating new areas of cover and encouraging good behavior, with the Joker cover option, which allows young drivers to get a free taxi home to avoid taking risks.

- Making a commitment to the environment by ramping up key partnerships with the sharing economy (such as with BlaBlaCar since 2015 or OuiCar).

- Combating exclusion through solidarity-based products, offering microinsurance for entrepreneurs from underprivileged backgrounds for instance.

An outstanding source of proposals for redefining the insurance industry, AXA is also opening itself up to an approach to co-build future policies, based around direct dialogue with its customers.

Following this conference, shareholders were invited to an informal meet-up and drinks to continue their discussions with the presenters and the shareholder communications team on these current topics.

*Based on findings from the third AXA Votre Service

Observatory survey.