September 5, 2016

I Believe I Can Fly My AXA Drone

7 minutes

Guillaume Lehallier and the AXA Drones team can’t get enough of innovation and are making it their job to inspire adjusters to use drones on an everyday basis. How can these unmanned devices be of use to insurers? And how can they best be applied, without getting sidetracked by all the opportunities in store? For the Paris Drone Festival 2016, Guillaume tells us his story.

The first time I heard drones discussed on TV was on the evening news. One of these high-tech machines had been spotted flying over a nuclear power plant. At the time, it seemed that the only part of this technological revolution that caught the media’s interest was the menacing, mysterious aspect of the unmanned vehicles. This type of anxious response is typical whenever a new technology emerges. But for tech fans like me, the strongest of all feeling is always one of excitement. I had been monitoring new civil uses of drones for a while, and I was beginning to glimpse the endless possibilities offered by this new technology, beyond providing yet another fear-mongering story for a hasty journalist.

For example, like other tech lovers, I knew that Amazon was already testing drones to deliver packages better and faster, especially to isolated areas; that the SNCF, the French national railway, saw drones as a way to prevent recurrent thefts of copper cable from its 30,000 kilometers of tracks, otherwise impossible to monitor; that the agricultural industry used drones for weather forecasting and supervising crops; and that in the United States, the insurer State Farm was considering using drones for its claims inspections. Could my employer, AXA, do the same? Was it considering it? I wondered, without really doing anything more: at the time, I was working in Group Human Resources, so technical innovation wasn’t exactly my field of work.

Then, I heard about Start-in, AXA’s global in-house innovation contest. Two coworkers, Laura Rosado and Ewa Sulima, and I decided to participate. Our project was to develop the use of drones in the group by convincing our management and our colleagues that we can use this technology to better protect our customers and do business more efficiently, especially with regards to protection and prevention. For example, drones could help to assess storm or flood damage to a town, find the source of a fire in an apartment or an entire building, and reduce the wait before inspecting a factory filled with toxic fumes. Of course, drones can go places that are risky for people. But most importantly, they can take an almost unlimited number of high-definition pictures and share them instantly with the competent teams.

Laura, Ewa and I quickly began meeting with drone experts, claims inspectors and loss engineers to get more information in each of these areas. That’s how we came to understand that this technology could do even more: a drone can be equipped not only with video and photo cameras but also with all sorts of sensors – heat, humidity, electromagnetic field, etc. – as well as GPS, altimeters and lasers to measure distances to the millimeter. All of these tools can be useful for claims adjustment, but also for prevention, basically by identifying anything likely to cause an accident or damage, finding weak points, and developing methods to avoid them.

To win this innovation contest, we first had to undergo some training ourselves. Like me, Laura and Ewa were based at AXA’s global headquarters and none of us worked directly with technology in our jobs. But we were naturally curious and motivated by the challenge, so we learned, we read a lot, we subscribed to trade magazines and websites, and we met with professionals in the field.

I will never forget this period in my life: the hours spent at the café with my partners before and after work, hunched over our laptops as we refined our case studies and business models; interviewing drone flyers and entrepreneurs who were setting up their own rental or image analysis businesses—or both; and of course our own express training in flying these vehicles, so we could gain some firsthand experience. The memory of our presentation at the Start-in conference in Paris—when we flew a drone just centimeters past Henri de Castries, the group’s CEO at the time—is etched in my mind! As is the party that followed after the results were announced and we learned that the project was really being implemented!

Today, we use drones in France, Switzerland, Belgium, Mexico and Turkey. We started small: a mission here, a mission there… Testing an idea against reality inevitably comes with lessons and surprises. We are still in the learning phase, but these new practices are already bearing some fruit. Yves Hanoulle manages claims adjustment for the Flanders region in Belgium. He opted for this electronic assistance

and puts it to use every day. Before,

he says, sometimes a claims adjuster would have to climb a 10- or 20-meter ladder, build a scaffold, or rent a forklift to access certain places. That means getting permission from the town authorities, since damage can be caused to the sidewalk or the customer’s house. It is time-consuming, risk-laden, and can be complicated to organize. It’s so much easier with the drone: we phone Dekra, our partner in Belgium, who sends a flyer to the scene with a fully-equipped drone. It’s incredible how much faster it is. And better for our customers and potential brokers, who can watch how the drone explores a building, right on the flyer’s tablet screen. They can therefore guide the flyer or suggest specific shots.

In Belgium, AXA works with the German company Dekra to carry out drone inspections

When a location may be unsafe,

continues Yves, we can operate directly, even if the place is filled with toxic fumes or littered with shards of glass, as was the case for a greenhouse once. If needed, we can make an initial assessment of causes or consequences when we first visit the location and starting paying a part of the total settlement amount sooner. At the end of the day, the benefit is for the customer. When someone can’t return to their home or place of work, any time gained is priceless.

Yves (pictured from the back, on the left) at the AXA Belgium press conference on the use of drones for claims inspections.

When it comes to emerging technologies, the key is of course to stay on your toes. The American research and advisory firm Gartner illustrated this perfectly in 2005 with its well-known hype cycle

. It shows—although of course this graph is refined in the full report supplies—that new technology follows the same pattern of stages. The first is the Peak of Inflated Expectations (the names of all the stages were coined by Gartner). This is when the innovation is seen as the solution to the world’s problems. We are experiencing this right now with driverless cars: people rave about them as the biggest revolution ever. But then, the innovation moves to the Trough of Disillusionment (when people discover all the problems that the invention can’t fix) and the Slope of Enlightenment (when the product is refined for truly relevant uses). On a global scale, this is where drones are now. For the past few months, our task at Group headquarters has consisted in examining dozens of real-life cases taken from AXA’s archives to assess what a drone could or could not have accomplished. We compare cost, timeframes and, most of all, the quality of the service delivered to the customer. We also examine all current feedback, country by country, analyze it and share what we learn with other regions.

Drone inspection of a tuna canning plant in August 2015, after the burst of a huge water tank

Most importantly, we are working intensively on image analysis: there is no use gathering gigabytes or even terabytes of data if we can’t understand them. But this is an area that is still being developed and perfected. I probably shouldn’t say this, but this is where it all plays out. That’s why we are now being assisted by the AXA Lab teams in Lausanne—in particular, Alexandre Delidais, who is working with us to develop tools and platforms to use the drone images more efficiently and eventually include this new data source into our claims adjustment processes.

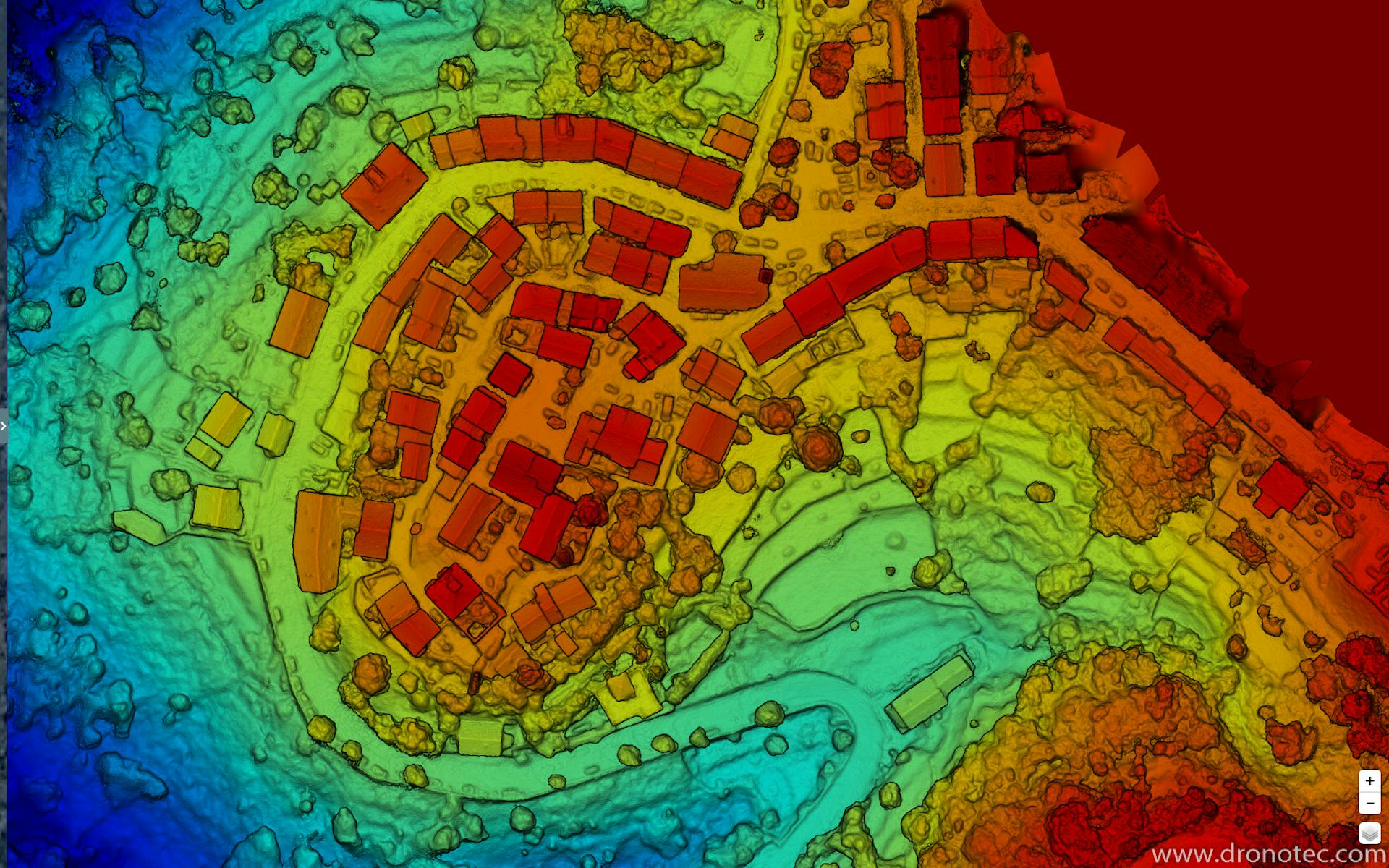

It’s also the reason why we are working with companies with whom we have established a relationship of trust, like Dronotec in France. Dronotec is a start-up specializing in technical inspections using drones and works with a network of 90 flyers throughout France. The company was founded by a former claims adjuster, Emilien Rose, who brings unparalleled skills to the table of image analysis and risk analysis. For example, after flying a drone over an area, the team can already create a 3D model of the damage and share it simultaneously with the various parties involved. Not so long ago, the only tool a claims adjuster had to record and share their observations was a notebook! This is a game-changer, especially when it comes to handling high-value claims such as losses caused by fire, flood or hail.

In the Western world, we haven’t yet reached the last stage in the Gartner cycle, the Plateau of Productivity. But we have clearly moved past the phase of fear, and drones are flooding into the mass market and landing beneath Christmas trees. This isn’t just an image: according to the GFK research firm cited by Le Monde, 100,000 drones were sold in 2014, compared with over 285,000 last year, almost three times as many! (source: LeMonde.fr (in French)).

Drone races in the United States and in Moscow, Seoul and Dubai attract hundreds of thousands of views on YouTube. In France, the contrast is striking: last year, when a drone flew over Paris, panic ensued. And now the Paris Drone Festival is being held over the Champs-Élysées! From a technical standpoint, these machines are sophisticated and affordable. In terms of attitudes, they are now the stuff of dreams rather than nightmares, suggesting that the market is ripe. I have to admit, I have a lot of progress to make in drone racing. I’m a long way from becoming a champion of this 2.0 sport! But what I enjoy most about drones is seeing how they are changing our everyday lives and talking with Turks or Belgians or Mexicans about how they are being used: at the end of the day, I am experiencing this revolution front and center, from the inside.